The crypto community often claims that Bitcoin is the ultimate hedge against rising consumer prices. The key point of the argument is that Bitcoin is engineered for scarcity – a limited and known total supply against expanding economies and increasing demand. Unlike fiat money and more like gold, it cannot be debased or devalued by a government or a central bank creating too much of it.

For example, in The Bitcoin Standard, one of the most influential books in the crypto space, the author Saifedean Ammous argues that Bitcoin's decentralised, fixed monetary supply makes it the best store of value that humans have created.1

In contrast to the British Pound or US dollar, Bitcoin and other cryptocurrencies are generally not controlled by any centralised authority and supply is limited at only 21 million. Each bitcoin is divisible into 100 million Satoshis, helping growth through smaller units of account as the value of bitcoin appreciates.

In recent months, after the COVID pandemic seemingly reached its peak, interest in this argument has increased against a backdrop of unprecedented fiscal and monetary expansion, mounting public debt globally and nervous inflation expectations.

How does this argument, however, stack up against the evidence? Let’s investigate step by step.

Inflation and Common Misunderstandings

Inflation – a general rise in the price level of an economy over time – is captured by several indicators provided by national statistics agencies. A popular inflation measure is the Consumer Price Index (CPI), a statistical construct that aims to capture the price over time of a basket of goods and services designed (and revised over time) to represent a hypothetical individuals’ consumption in that country. The basket proxies any given person's consumption pattern, and hence it is an imperfect indicator, but nonetheless tends to be a reasonable measure of inflation for the aggregate economy.

An apparent source of confusion in the crypto space is the difference between asset price appreciation and inflation. These are two very different concepts: the former refers to the market value of assets we obtain as investment opportunity, the latter to the price of goods and services we acquire to consume. The dynamics of the two are rather different to each other.

In fact, national statistics agencies exclude from the computation of inflation, all changes in the value of investments such as equities, real estate, bonds, bitcoin or gold. Including any asset price into the CPI basket would mix consumption and investment goods, and importantly mix up inflation and asset appreciation. Unlike consumption, where goods and services are used purely to enjoy them, investments are made to earn future income.

To clarify the point, an important case study (and a tricky one) is house prices. This is often a source of debate since housing is an important and necessary cost faced by consumers. Yet, national statistics agencies try to exclude the investment element of home ownership, particularly the cost of land, when computing the CPI.

Indeed, statisticians have long resisted including house prices in headline inflation measures. For example, in 2016 the UK’s Office for National Statistics observed that: “A consumer price index aims to measure consumption, whereas the purchase of a house is the purchase of an asset that is not consumed in the same way as other items.” 2 This view is common to all of world’s leading national statistics agencies - i.e. one should include either rental costs or use a “net acquisitions” method that seeks to measure the change in price of purchasing homes, but not of the land on which they are built.

How Large is the Inflation Risk?

In recent months, economists have discussed the risks to the inflation outlook with divergent views. The world economy has started enjoying a rather vigorous but divergent recovery, with the divergence largely explained by the degree of access to SARS-COV-2 vaccines. The question is, what will happen to prices?

For example, Larry Summers warned about the inflation risks created by the $1.9 trillion fiscal stimulus package put in place by the Biden administration – "macroeconomic stimulus on (this) scale … will set off inflationary pressures of a kind we have not seen in a generation".3 His assessment was shared by Olivier Blanchard – and backed by specific calculations – in a series of tweets and then in an article for the Peterson Institute.4

Paul Krugman offered a different view in his blog. Referring to the flattening of the Philips Curve over the past few decades, as reported by a few recent empirical works, Krugman considers that "even a very hot economy only leads to modest inflationary overheating".5

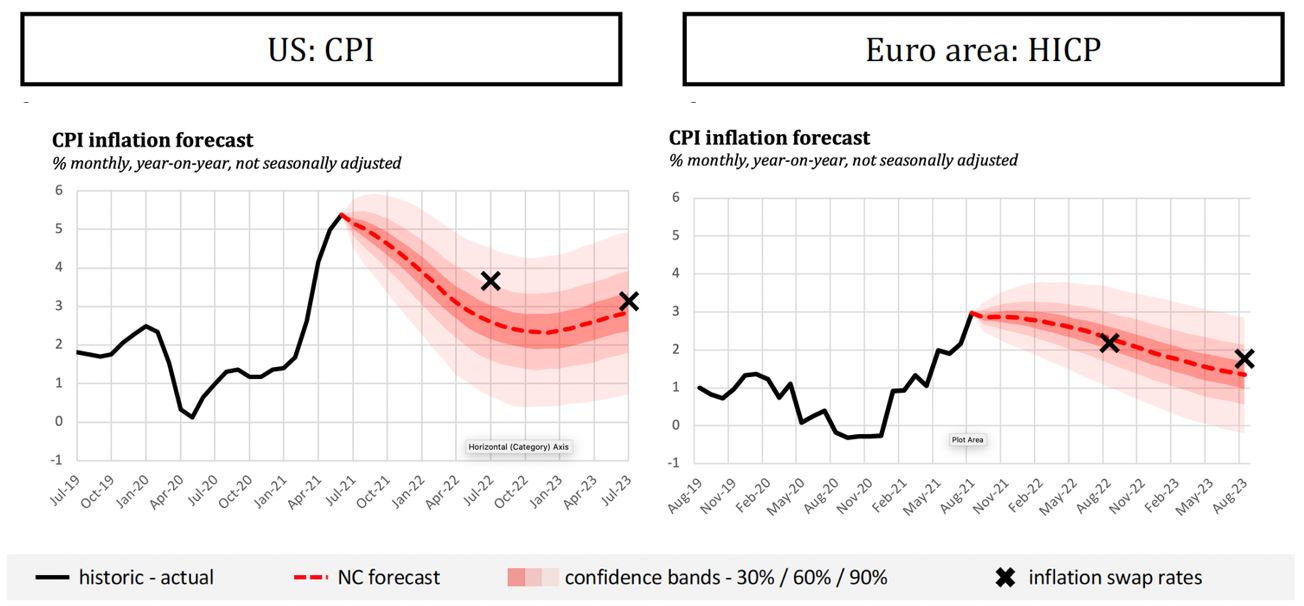

Yet, most of the data so far has not showed signs of de-anchoring. Also, analysts, while pointing to some risks, generally agree that increases in inflation in recent data releases are likely to be temporary and due to specific supply bottlenecks and increased demand following a period of suppressed consumption during the pandemic. In fact, neither slack in the economy or inflation expectations point to de-anchoring or a risk of high inflation. For example, Figure 1 below reports inflation swap rates, a measure of market expectations, and inflation forecasts for the US and the Euro Area.

Figure 1: Inflation Forecasts and Inflation Swap Rates

The Case for Bitcoin as an Inflation Hedge

Inflation risk aside, are bitcoins and other cryptoassets an inflation hedge? Probably not.

Assets that provide an inflation hedge are those that have a negative price correlation with the assets with value one would like to protect. To be a perfect hedge, an asset would need to have a negative correlation of one with the asset to be hedged.

Bitcoin and other cryptoassets are uncorrelated with every other asset class, with correlations close to zero across the board, and in particular vs inflation. 6 Thus, they can be thought of as opportunity to diversify investment portfolios rather than hedge. For example, Christopher Louney of RBC Capital Markets has written that “Bitcoin’s nearly complete lack of meaningful correlations with other assets presents it as a diversifier…”.7

The same is particularly true for inflation. For example, Bank of America commodity strategists note that “Looking year by year, we find that Bitcoin has been positively correlated with CPI inflation in 5 out of the 9 past years, with the largest correlations in 2014 and 2018. However, when looking at correlations with inflation surprises since 2011, we find that Bitcoin has among the lowest co-movements, lagging most asset classes such as commodities, TIPS, and EM FX in particular.” 8

This view, based on facts and the standard understanding of what is a hedge asset, does not chime with what many believe in the crypto space. Let’s investigate why.

What Is Then The Argument?

There seem to be two sources of confusion. The first is the difference between inflation and returns we mentioned before. The second is the idea that since scarcity has been built into Bitcoin’s code, this alone guarantees its function as a Store of Value.

Let’s go in order. Many in the crypto world often confuse high returns – which are often not adjusted for risk – with “inflation hedge” properties. As explained, to be an inflation hedge, an asset must correlate with unexpected changes in inflation, i.e. inflation surprises, but cryptoassets appear to have very low correlation with inflation surprises.

The lack of correlation of bitcoin and other cryptoassets with inflation and other asset classes, combined with their high volatility, does not offer or guarantee any protection against high inflation and other macro shocks. It is possible that a sharp rise of inflation could have the opposite of the expected effect on bitcoin. For example, if inflation is associated with a supply shock and a recession, investors might react by offloading what are perceived as riskier assets such as cryptoassets and moving into lower volatility assets.9

The second source of confusion relates to whether scarcity guarantees protection from inflation. Scarcity and decentralisation guarantee that a central authority cannot debase bitcoin, yet does not guarantee its value in nominal or real terms. Bitcoin's value is based entirely on other people’s willingness to hold it – it is not tied to any other asset that could possibly naturally rise in value along with consumer prices.

As a final note, it is worth observing that the argument surrounding the Store of Value function of bitcoin and other cryptoassets is often connected to views on how unconventional monetary policy may debase the value of the dollar or other fiat currencies.

While it is true that the increase in liquidity, caused by quantitative easing, might end up fueling asset price bubbles, so far, despite large increases in central bank balance sheets, inflation has remained low over the last ten years. Inflation in the US, UK and in the Euro Area has barely moved.

Conclusion

Bitcoin and other cryptoassets do not seem to have the properties that would characterise them as an inflation hedge. The claim of Bitcoin being a perfect hedge against inflation seems to be based on a misunderstanding of what inflation is and what an asset that hedges against risk is.

Overall, while inflation risk still remains low, it is still relevant to any investor because, if materialised, it can erode real returns. Yet, the rationale for holding cryptoassets should not reside in the assessment of these risks.

Footnotes

1 Saifedean Ammous, “The Bitcoin Standard: The Decentralized Alternative to Central Banking”, Wiley. June 2018. ISBN: 978-1-119-47386-2

https://www.wiley.com/en-am/The+Bitcoin+Standard%3A+The+Decentralized+Alternative+to+Central+Banking-p-9781119473862

2 Measures of owner occupiers' housing costs, UK: April to June 2016

https://www.ons.gov.uk/economy/inflationandpriceindices/articles/understandingthedifferentapproachesofmeasuringowneroccupiershousingcosts/quarter2aprtojune2016

3 Larry Summers, The Washington Post, 2021

https://www.washingtonpost.com/opinions/2021/02/04/larry-summers-biden-covid-stimulus/

4 Olivier Blanchard, “In defense of concerns over the $1.9 trillion relief plan,” Peterson Institute, February 18, 2021. https://www.piie.com/blogs/realtime-economic-issues-watch/defense-concerns-over-19-trillion-relief-plan

5 Paul Krugman blog

https://paulkrugman.substack.com/p/stagflation-revisited

6 Analysing correlations between cryptoassets and traditional asset classes

https://en.aaro.capital/Article?ID=9e7aff76-4908-4fbc-8682-cd970293607f

https://en.aaro.capital/Article?ID=503c42ba-df78-4037-b933-8713799b7cc9

7 Bitcoin Isn't Acting Like an Inflation Hedge. Gold Isn't Either.

https://www.barrons.com/articles/bitcoin-isnt-acting-like-an-inflation-hedge-gold-isnt-either-51614983486#:~:text=Gold%20Isn't%20Either

8 The main argument for owning bitcoin is 'sheer price appreciation,' not diversification or inflation protection, Bank of America says

https://markets.businessinsider.com/news/stocks/bitcoin-price-today-inflation-hedge-portfolio-bank-of-america-price-2021-3

9 Note that according to analysis undertaken by Dr. Daniele Bianchi, bitcoin appears to be a risk neutral asset like gold. https://en.aaro.capital/Article?ID=9e7aff76-4908-4fbc-8682-cd970293607f