The crypto community often claim that Bitcoin is the ultimate hedge against inflation. This is due to a fixed supply curve that cannot be manipulated by any government or central bank to debase the cryptocurrency.

Historically, assets such as gold, property and equities have played an important role in protecting wealth from the effects of inflation.1 Properly defined, assets that provide a hedge against inflation are those who's price has a positive correlation with consumer price changes, especially inflation surprises. To be a perfect hedge, an asset's price would need to have a positive correlation of one with inflation, but such assets do not exist. Investors seek safe haven assets to shelter and diversify from the effects of inflation on their purchasing power.

Cryptocurrencies – often referred to as ‘‘digital gold’’ – are described as an investment option that provides an alternative to traditional inflation hedges. In a recent article, we considered many of the common arguments supporting this claim.2 In this post, we dig deeper into some of the recent research on whether cryptoassets can act as an inflation hedge.

Bitcoin as an Inflation Hedge

Recent research covers several arguments for and against the possible role of cryptoassets as an inflation hedge.

The ease of which cryptoassets are traded and stored – despite some security risks – is a desirable property allowing for greater cost efficiency compared to other inflation hedges such as gold or other commodities. However, a recurrent observation is that cryptoasset prices are highly volatile, thus reducing their potential as inflation hedge.3

Also, cryptoassets are exposed to liquidity risk, like traditional assets. This reduces their effectiveness as a hedge.4 However, they may price information from several other and opaquer sources, none of which are likely to correlate with expected inflation. Hence, while they provide some diversification benefits to investors, they may fall short as an inflation hedge.5

Yet, the key question that research is yet to answer remains the correlation of cryptoasset prices with price inflation. This is clearly a difficult question to answer empirically due to the limited time period over which cryptoassets have traded and in which the market has been sufficiently liquid.

Inflation Expectations and Cryptoassets

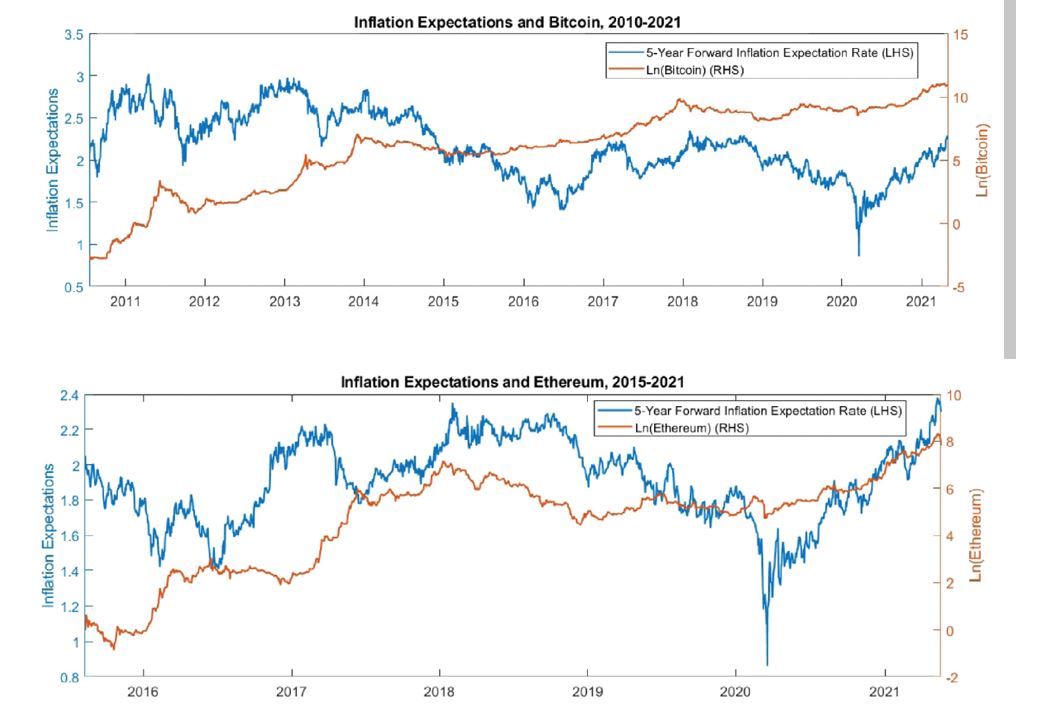

A few recent papers have attempted to assess the properties of Bitcoin and other cryptoassets as inflation hedges. A good starting point is a simple plot of inflation expectations against Bitcoin and Ethereum prices (in Figure 1).6 An eyeball inspection of the chart does not reveal a striking correlation; however, some interesting co-movement seems to be present during the COVID-19 crisis.

Figure 1: Inflation Expectations and Bitcoin and Ethereum prices (in logs)

A recent paper by Blau et al. (2021) has shown that, over the sample, there may be a causal link between both Bitcoin and Ethereum and expected inflation.7,8 They report that changes to Bitcoin prices can be used to forecast changes in the forward inflation rate, indicating that Bitcoin might act as a hedge against forward inflation expectations. In this analysis, it has been conjectured that increasing inflation expectations may be linked to cryptoasset price appreciation and possibly related to the use of unconventional monetary policy tools (e.g. quantitative easing, zero and negative interest rate policies).

What is the cause of these results that is not apparent in a quick scan of the price and inflation plots? Another recent paper (Conlon et al 2021) has tried to answer this question, analysing different subperiods within the dataset.9 Their empirical findings point to the result being driven by a brief positive relationship between forward inflation expectations and both Bitcoin and Ethereum, that in fact coincide with the initial stages of the COVID-19 crisis, where high correlations across many different asset classes were observed.

More precisely, they report that a positive link is evident, coinciding with the rapid and synchronized decrease in both forward inflation expectations and the price of cryptoassets at the onset of the COVID-19 pandemic. However, outside of this period, they are not able to find any significant evidence that cryptoassets may act as a hedge during periods of steepening forward inflation expectations.

These findings suggest that there is very weak evidence that cryptoassets hedge against increases in forward inflation expectations. However, as with other assets, it is likely that cryptoasset prices incorporate some price-related information from factors affecting forward inflation expectations in periods of crisis.

Conclusion

Empirical research in finance has so far failed to show that Bitcoin and other cryptoassets have the properties that characterise them as an inflation hedge. In fact, they do not meet the criteria expected of an inflation hedge – both in terms of their correlations and in terms of their broader properties.

While during the COVID-19 recession, there was an apparent co-movement between Bitcoin and forward inflation expectations, whether this correlation is a statistical fluke or a property of cryptoassets in recessions is yet to be understood. The liquidity crunch aspect of the COVID-19 recession may explain the increased correlation during this period.

In the light of the recent research, investors should consider cryptoassets and Bitcoin as speculative assets - that may drop in value alongside other assets during recession - and as an opportunity for portfolio diversification.

Footnotes

1 Asset prices factor in both forward expectations in earnings growth of stocks and expectations of inflation. Thus, they can act as a hedge against anticipated inflation (see Bodie, 1982). Conversely, commodity prices are based on supply and demand dynamics offering hedging benefits (see Zaremba et al., 2019).

2 Giovanni Ricco, “Is Bitcoin the New Inflation Hedge?”

https://en.aaro.capital/Article?ID=16ae8abe-3a2b-4fb6-adb6-84cb954f6e1d

3 See, for example, Shen, D., Urquhart, A., Wang, P., 2020. “Forecasting the volatility of Bitcoin: The importance of jumps and structural breaks.” European Financial Managing 26 (5), 1294–1323.

4 See, for example,

- Conlon, T., McGee, R., (2020) “Safe haven or risky hazard? Bitcoin during the COVID-19 bear market.” Finance Research Letters 101607.

- Conlon, T., Corbet, S., McGee, R., 2020, « Are cryptocurrencies a safe haven for equity markets? An international perspective from the COVID-19 pandemic.” Research in International Business and Finance 101248.

5 Urquhart, A., 2018, “What causes the attention of Bitcoin?” Economics Letters 166, 40–44.

6 It is worth reminding that while for Bitcoin its fixed supply may be seen as providing a guarantee on the store of value function, this is not true in the case of Ethereum. In fact, Ethereum does not have an issuance limit, yet it has been shown to co-move with the cryptoasset market.

7 Blau, B., Griffith, T., Whitby, R., 2021. Inflation and Bitcoin: A descriptive time-series analysis. Economics Letters 203, 109848.

8 Some currency hedging capacity has also been reported in the literature by Urquhart, A., Zhang, H., 2019, “Is Bitcoin a hedge or safe haven for currencies? An intraday analysis.” The International Review of Financial Analysis, 63, 49–57.

9 Conlon, Thomas & Corbet, Shaen and McGee, Richard J., 2021. "Inflation and cryptocurrencies revisited: A time-scale analysis," Economics Letters, Elsevier, vol. 206(C).

Disclaimer