The world of cryptoassets is fast-evolving, with technological innovation colliding with traditional financial and regulatory models, and new financial businesses and services are constantly emerging. The overarching tension is between the libertarian and borderless intuition that has driven the development of cryptoassets since the creation of Bitcoin, and the need for regulation and standardisation that would increase adoption and trust in these new financial assets.

How will DLT and cryptoassets reshape the financial sector and beyond? Will innovation or standardisation, centralisation or decentralisation, peer-to-peer or corporate prevail? Much will hinge on the interaction between regulatory frameworks and technological innovation. This note explores the risk landscape of cryptoassets, its implication on macroprudential policies, and the types of regulatory frameworks that may subsequently emerge.

Risks in The Crypto Ecosystem

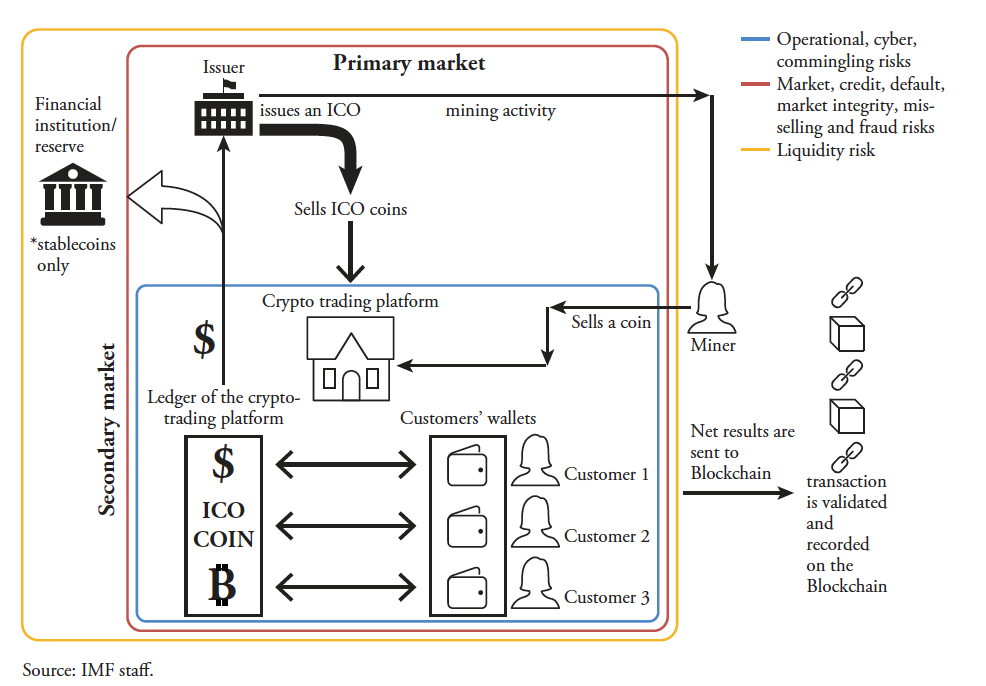

Figure 1: Market Structure of Cryptoassets

Many central banks, national supervisory authorities, and international bodies have voiced concerns about market integrity and consumer protection issues, but also security risks due to illicit activities including money laundering and terrorist financing that may take place on the blockchain (among others, CPMI 2015, G20 Finance Ministers and Central Bank Governors 2018, Bank for International Settlements 2018, Carstens 2018a,b, Financial Stability Board 2018, Carney 2018).

To explore the multifaceted risks entailed by cryptoassets, we start by looking at where they are localised. Figure 1 is taken from the IMF FinTech Notes on the `Regulation of Crypto Asset’, and provides an assessment on where different types of risks are localised along the production and transaction chain of cryptoassets.

Risk at the Issuance – Primary Market

We start in the diagram at the point where a venture issues an initial coin offering (ICO) backed up by a white paper or just a plain public offer (perhaps supported by miners). The new asset is essentially a new product with no benchmark and with an intrinsic technological complexity that is possibly higher than some of the most sophisticated financial products. The information asymmetry between the public and the issuer is therefore large. This entails non-negligible investor risks due the lack of transparency, the risk of mis-selling, unlawful activities such as Ponzi schemes, and even plain fraud in the offer of cryptoassets.

Risks in Crypto Services

Once cryptoassets are created, they can be traded and need to be safely stored.

Custodial and wallet services pose investor protection concerns due to segregation and safe handling of client assets. In fact, the potential for commingling of the client assets with those of the service providers in a largely unregulated sector can result in large losses if the crypto service provider goes bankrupt. This is a large risk where there no strong regulatory framework can guarantee client protection.

Further, trading entails both operational and cyber risks. Several cases in the past few years made headlines because of large security breaches, during which crypto-trading platforms and wallet providers have been hacked and the client coins have been stolen. For example, in 2018, Coincheck had $534 million worth of crypto stolen by hackers.1

Market Risks – Secondary Market

Market integrity is an important risk in a crypto market where many assets are illiquid, have a short history of existence, and limited information.2 Importantly, many cryptoassets are not backed by tangible assets or other securities and thus their price depends on market trust and expectations. The price discovery process of the market is inevitably poor and therefore such assets are at high risk of market manipulation via wash trades and pump-and-dump schemes (see Li et al 2018).3, 4 Also, low trading volumes make markets vulnerable to other forms of market manipulation, such as “whale” trades.5

Cryptoassets are often highly volatile, and investors and crypto-trading platforms are exposed to material market risk. Even stablecoins are potentially subject to the credit and default risk of the issuer. Deterioration of the issuer’s credit worthiness would be reflected into the price of the issuer’s coins and tokens.

Liquidity Risk of Issuers and Service Providers

Issuers of some assets allow redemption. Investors may expect that they would be able to exchange the coins and tokens with crypto-trading platforms without material redemption cost. However, times of stress in the market, or even localised issues with one platform, may ingenerate a bank-run-type situation with a rapid depletion of collaterals and cryptoassets becoming either very illiquid or unredeemable.

Regulatory Risks

The level of anonymity or pseudo-anonymity that cryptoassets afford also create security risks to their potential misuse for money laundering and terrorist financing. The emergence of ever more sophisticated mixer and tumbler services as well as anonymity-enhanced cryptoassets (for example Monero, Z-cash) makes this asset class potentially very exposed to aggressive changes of regulation or even to ban tout-court.6

Systemic Risks

Finally, the exposure of the financial sector to cryptoassets can raise prudential and financial stability implications. On the one hand, cryptoasset providers and issuers are increasingly engaging with traditional financial institutions - through derivatives, providing crypto linked products and cyber insurance - while at the same time modifying the competitive landscape of the financial sector. On the other hand, financial institutions and investors alike are engaging with cryptoassets gaining exposure to this new market. These exposures could trigger contagion risks if the size of the crypto market continues to grow in the future and the emerging risks are not managed properly.

At the present, however, the systemic risk of cryptoassets is generally considered very limited. In fact, the IMF’s and the World Bank’s Global Fintech Survey conducted in early 2019 found that most supervisors consider that cryptoassets present risks to investors, but are not a threat to financial stability.

On the other hand, in March 2019, the Basel Committee on Banking Supervision (BCBS) highlighted that the continued growth of cryptoassets has the potential to cause financial stability concerns and increase risks faced by banks.

A possible scenario could include much wider use of cryptoassets by large institutional investors (such as asset managers, insurance companies, and pension funds). Wider use of crypto-based payment systems (such as for cross-border payments) could also materially increase the number of transmission channels between cryptoassets and financial institutions in the future.

A rapid growth in the adoption and diffusion of cryptoassets would make them systemically relevant. Platforms providing storage, payment and possibly lending services could become large financial sector players carrying systemic risks comparable to large national or global banks.

Conclusions

Crypto investors, users and service providers are exposed to a high amount of risk. The inherent volatility of major cryptoassets, together with technology features and anonymity, create several significant risks not only to investors but also to service providers, and ultimately may result in the build up of systemic risk in the financial system.

From the point of view of individual investors, the emergence of a deeper and more sophisticated market (with multiple layers from investors to funds to financial institutions) could reduce the extent of information asymmetry, calm asset volatility, and mitigate market risks.

At a systemic level, the rapid development of the market provides a challenge to authorities and standard setters to develop sound regulatory and supervisory approaches to contain the risks while supporting healthy innovation.

The establishment of legal frameworks for cryptoassets could increase their value, as argued by Auer and Claessens (2019). The argument is that a regulatory framework allows for trust in the assets and hence expands the number of consumers and investors willing to trade, thus increasing their value.

Ultimately, the question is whether it is possible to strike the right balance between the libertarian inspiration that has created cryptoassets and the need of regulation and standardisation that would expand adoption and trust in these new financial assets.

Bibliography

Raphael Auer and Stijn Claessens, Cryptocurrencies: Why not (to) regulate?

Bank for International Settlements (2020), ‘Designing a prudential treatment for crypto-assets’, BIS Discussion paper: https://www.bis.org/bcbs/publ/d490.htm

Cristina Cuervo, Anastasiia Morozova, and Nobuyasu Sugimoto (2020), `Regulation of Crypto Asset’, FinTech Notes No. 19/03, International Monetary Fund (IMF): https://www.imf.org/en/Publications/fintech-notes/Issues/2020/01/09/Regulation-of-Crypto-Assets-48810

Carney, M (2018), FSB Chair’s letter to G20 finance ministers and central bank Governors, 13 March.

Carstens, A (2018a), “Money in the digital age: what role for central banks?”, lecture at the House of Finance, Goethe University, Frankfurt, 6 February.

Financial Stability Board (2018), Crypto-assets: report to the G20 on the work of the FSB and standard-setting bodies.

Committee on Payments and Market Infrastructures (2015), Digital currencies, November.

G20 Finance Ministers and Central Bank Governors (2018), Buenos Aires Summit communiqué, 19–20 March.

Li, Shing and Wang (2018) “Cryptocurrency Pump-and-Dump Schemes” (Working Paper): https://papers.ssrn.com/sol3/papers.cfm?abstract_id=3267041

Jens Weidmann (2016) “Macroprudential policy through the lens of Sherlock Holmes”, Welcome address by Dr Jens Weidmann, President of the Deutsche Bundesbank and Chairman of the Board of Directors of the Bank for International Settlements, at the 5th Annual Macroprudential Conference, Eltville, 21 June 2016: https://www.bis.org/review/r190627d.htm

Footnotes

1 BBC News, Coincheck: World's biggest ever digital currency 'theft', https://www.bbc.co.uk/news/world-asia-42845505

2 The risk to market integrity is also visible in the strong market segmentation that exists in the crypto market. A notorious example is the ‘Kimchi premium’ – i.e. the fact that the price of bitcoin in Korea regularly exceeds that in the US, at times by over 50% (see Auer and Claessens, 2019).

3 Pump-and-dump schemes represent a form of price manipulation that involves artificially inflating an asset price before selling at a higher price for a profit. A pump is a coordinated (sometimes over Telegram or a similar messaging app), intentional, short-term increase in the demand of a market instrument which leads to a price hike. Price inflation is typically the result of a coordinated buy order amongst a selected group of investors.

4 A wash trade is a form of market manipulation in which an investor simultaneously sells and buys the same financial instruments to create artificial activity in the marketplace.

5 A bitcoin whale is used to refer to individuals, or institutions, that hold large amounts of bitcoins.

6 Several jurisdictions have decided to ban cryptoasset activity – among others, Algeria, Bahrain, Bangladesh, Bolivia, China, Colombia, the Dominican Republic, Indonesia, Iran, Iraq, Morocco, Nepal, Kuwait, Kyrgyzstan, Macao SAR, Maldives, and Qatar. The enforceability of such bans is debatable.