Money Supply and (Crypto) Asset Prices

What drives cryptoasset prices and cycles? The view that cryptoassets are decoupled from traditional assets and that the key driver of fluctuations in the crypto market are internal factors, such as bitcoin halvings, no longer rings true. In this article we explore the relationship between monetary variables and asset prices, and how monetary policy and global liquidity can affect cryptoassets.

Introduction

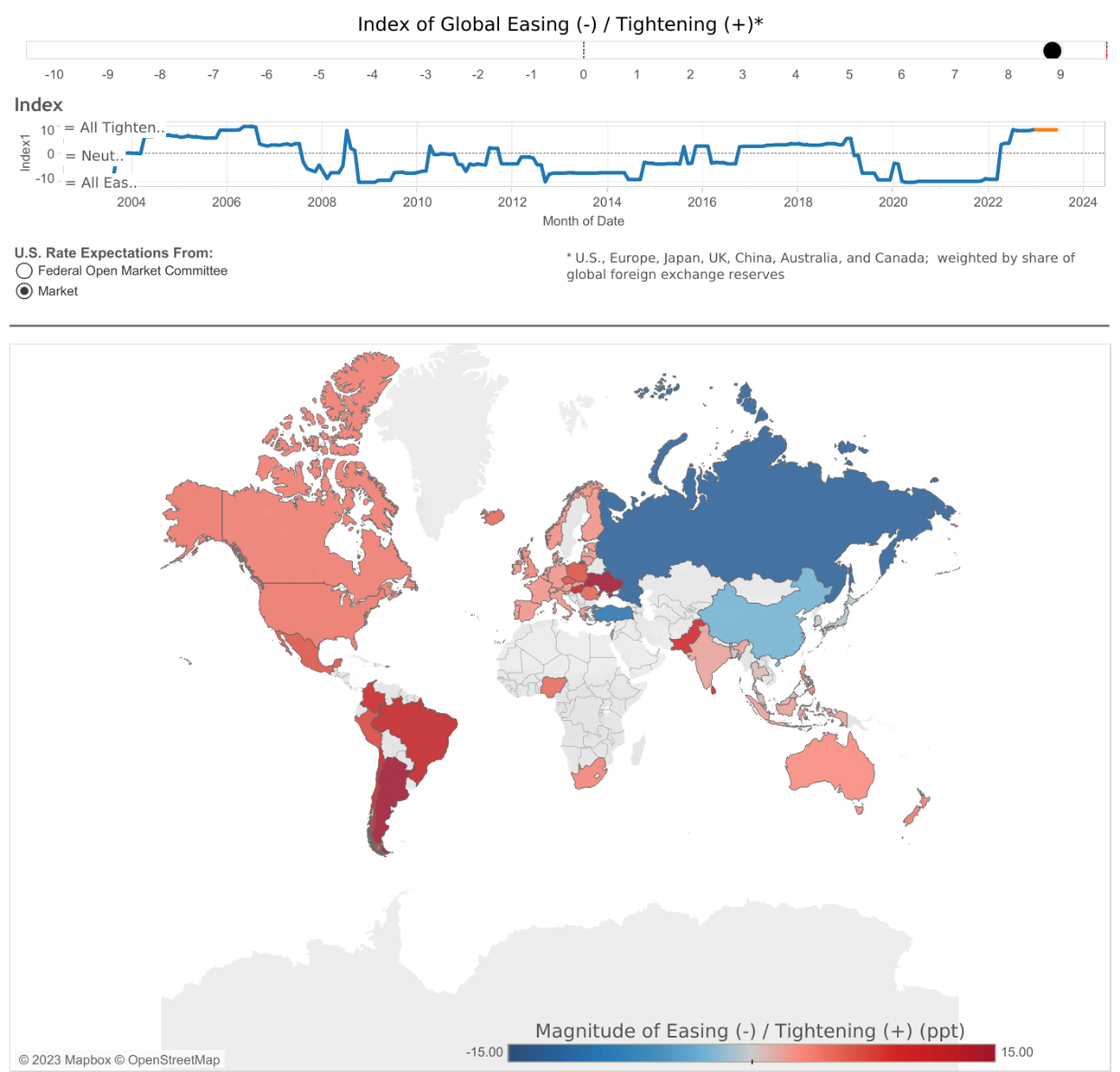

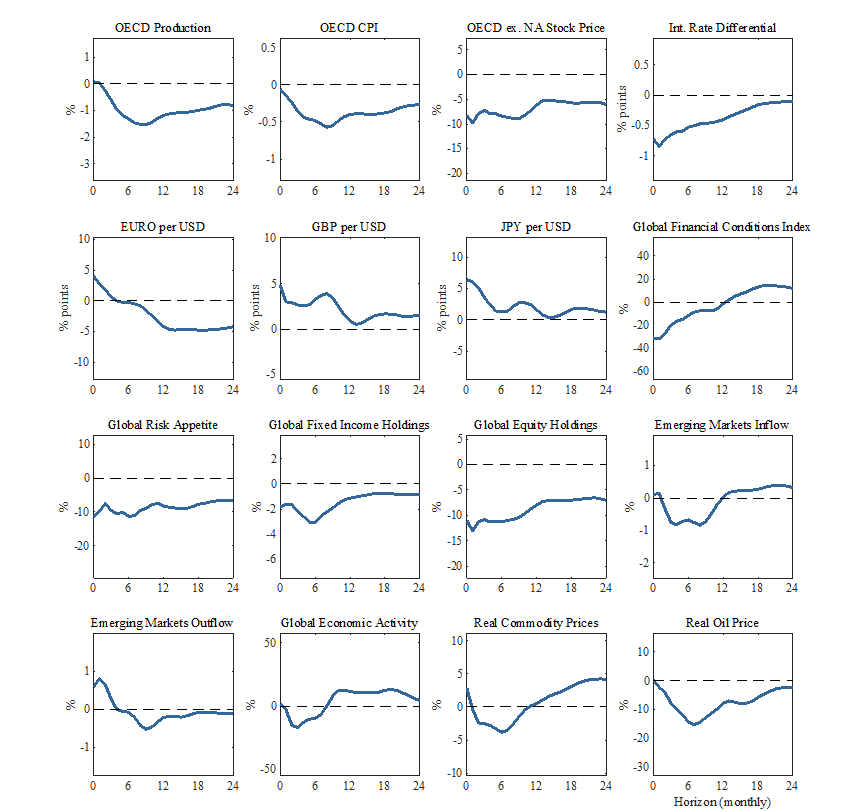

Across the global economy, in response to high inflation, leading central banks have tightened monetary conditions and started withdrawing liquidity (Figure 1). The tightening has driven a sharp adjustment in the price of risky assets, including cryptoassets.

A dramatic multibillion-dollar rout in the crypto market at least in part caused by aggressive interest rate hikes, has seen the bitcoin tumbling to a low of US$15,632, Terra and other stablecoin pegs collapsing, FTX’s bankruptcy and criminal allegations, and a general bear market. Several institutional investors offloaded their crypto positions – Tesla, for example, is reported to have scaled down most of its exposure.

Figure 1 – A Global Tightening

The recent correlation between crypto and risk-on assets has led the crypto community to reassess the question of what drives “cycles” in the market and how macroeconomic factors can drive fluctuations in the crypto market.

The previously commonly accepted view by market participants was that the Bitcoin halving cycle is the main driver of changes in cryptoassets, as the market is relatively decoupled from other assets and not linked to macro fundamentals. Every four years, block mining rewards are reduced by half while the total volume of bitcoins gets closer to the 21 million supply limit. The halvings are thought to have induced, in the past, market-wide switches from bull to bear.

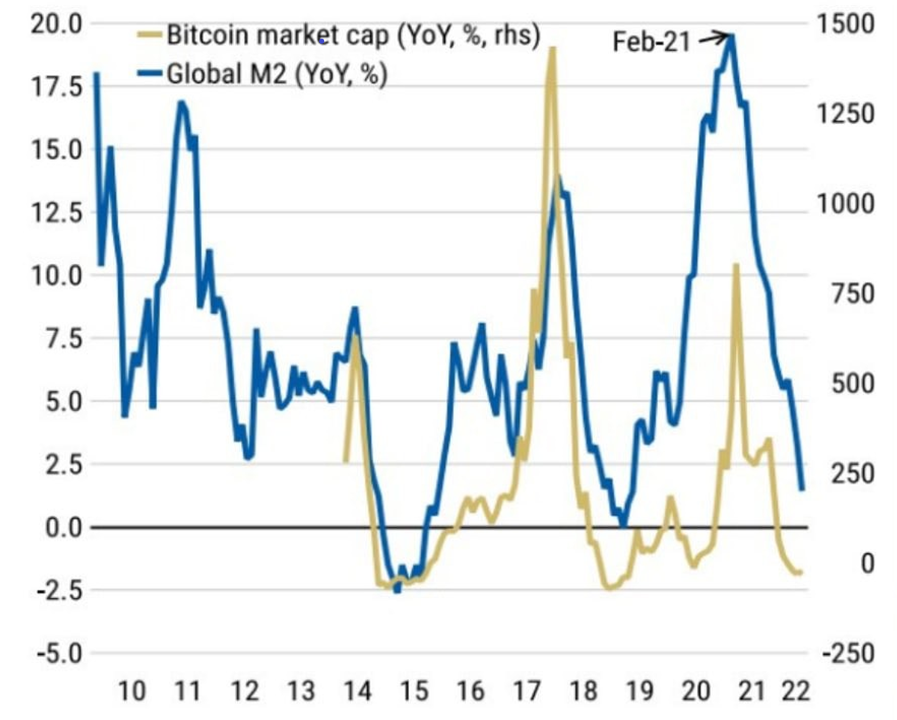

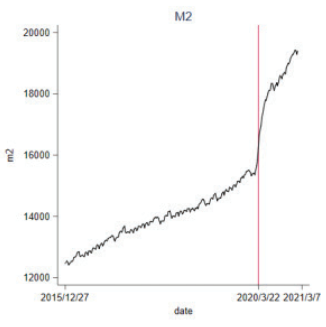

Challenging this view, in a blog post, Max Gottlich observed that “historical data seems to suggest that money that is being circulated throughout the U.S. economy serves as an indicator for what the direction for the price of Bitcoin (BTC-USD) will be based on historical data.” Following up on this idea, charts similar to Figure 2 seem to suggest there could potentially be a macro relationship.

Figure 2 – Global M2 and the crypto cycle

A possible interpretation of the plot, put forward by Raoul Pal, in line with the Austrian view, is that “liquidity and currency debasement are the predominant drivers, as opposed to supply” in the adoption of bitcoin. This view is not fully convincing since, if true it would explain a trend of adaption but not a cycling behaviour.

This article offers a discussion of the relationship between monetary variables and asset prices, and a different point of view on why monetary policy and global liquidity affect asset prices and in particular the crypto market.

Monetary policy and asset prices

Let’s start by thinking of how monetary policy affects asset prices. Several mechanisms transmit the policy stance to the price of stocks. Altogether, these mechanisms form the “asset price channel” of monetary policy.

The classical theory of asset prices states that the price of an asset is a function of the present value of the expected flow of earnings and the perceived risk in holding the asset.

Two variables determine the present value: the forecasts of future income and the expected path of the interest rate that is used to determine present values. The risk premia depend on both the perceived quantity of risk – for example, due to volatility – and the price that investors are willing to accept for holding that risk.

It is worth stressing, that the asset price channel of monetary policy produces an inverse relationship between interest rates and movements in asset prices, and a positive correlation between asset prices and the quantity of money.

To clarify, let’s think of the case in which the central bank increases the policy rate and hence the real rate in the economy, and this does not happen in response to deteriorating economic conditions.

First, the risk-free rate increases and the tightening propagates along the term structure of the yield curve. This implies that future earnings are discounted with a higher interest rate and thus asset prices adjust downward.

Second, monetary policy also affects the actual prospects of the firm’s future earnings via the macroeconomic channels – a decrease in aggregate demand and hence production, and profits. The expected reduction in earnings adds to the downward adjustment of asset prices.

Third, higher interest rates could make it more expensive for firms to borrow – and possibly increase the default risk –, thus reducing the firm’s level of investment and in turn again reducing expected future earnings and asset prices.

Finally, monetary policy can change risk premia. Indeed, it has been widely documented that monetary policy can trigger changes in risk attitude by increasing risk appetite during easings and lowering it when tightening. The higher the risk premium the lower the prices.1 The riskier the asset the larger the adjustments in price.

Hence, a monetary policy tightening can create a risk-off environment – where corporate earnings downgrades and expectations on economic development are pessimistic – triggering the shedding of risky assets and a rush to safe investments.

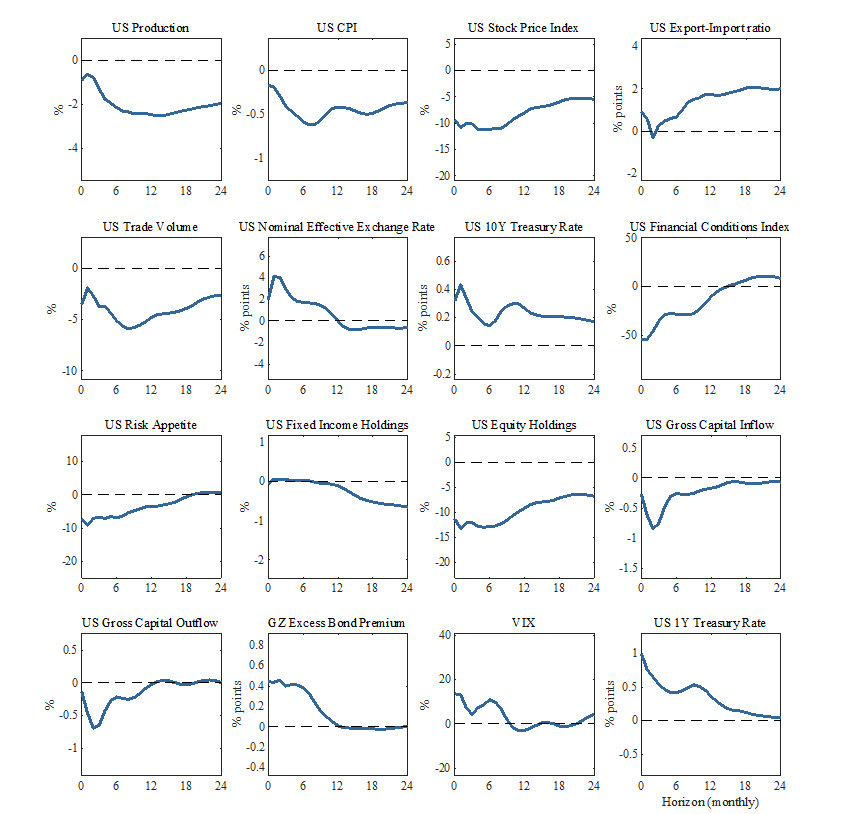

Are these theoretical mechanisms validated by empirical research? Yes, an exogenous tightening of the Fed is found to induce a sharp adjustment in asset prices and the stock market, deterioration of financial conditions, reduction in risk appetite, and the rebalancing of portfolio holdings with the offloading of riskier assets (Figure 3).

Figure 3 – The effects of a monetary policy tightening in the US

Central banks, the quantity, and the price of money

The “asset price channel” explains how monetary policy actions affect, among other things, asset prices. However, interest rates and the money stock are not solely determined by “exogenous” shift in monetary policy but they respond to economic conditions via changes to the demand for money along the business cycle.

Also, modern central banks do not generally directly intervene by changing the quantity of money in response to economic conditions that affect the demand for liquidity. (Quantitative easing operations can be seen as a particular form of intervention in non-standard market situations.) Conventional monetary policy affects the price of money – i.e. interest rates along the yield curve, by changing the policy rate (the interest rates on the reserves) in response to macro shocks – and letting the quantity of money adjust. Indeed, the money supply is largely endogenous to economic developments and not an exogenous “disturbance”, as the Austrian view would have posited in the past.

To understand how macro conditions affect rates and the stock of money, let’s think of a positive demand shock to the economy. An increase in expected demand implies an increase in money demand (and rates), in anticipation of the increase in economic activity. Higher economic activity implies higher expected profitability, which causes stock prices to rise.

How does monetary policy respond to macro conditions? When demand is strong, pushing up inflation, earnings, and asset prices (as well as the demand for money), the central bank adjusts rates up to cool down the economy and stabilise inflation. And vice versa. This implies an endogenous and positive association between asset prices, money stock, and rates.

To sum up, causality can go in two directions: from macro conditions to interest rates and the stock of money, and from monetary shocks to macro conditions and asset prices. However, modern macro has shown that the old monetarist view that monetary policy was the main driver of fluctuations in the economy is not supported by data (see for example Sims’ Nobel prize lecture in 2012). A large body of research has conclusively proven that the interest rates and the policy rates largely fluctuate in a predictable manner due to macroeconomic shocks that affect the entire economy, while the “exogenous” monetary component is relatively small.

Is crypto different?

Yes. Cryptoassets and bitcoins generally do not provide holders with cash flows, nor provide claims on some underlying assets. Hence their value does not depend on a stream of earnings but only on expectations of their values in the future, and risk factors, that can be also heterogenous across investors.

Hence the key channel through which monetary policy can affect crypto prices is via changes to risk appetite and portfolio rebalancing. If an investor perceives returns on crypto as volatile, an increase in interest rates which triggers a risk-off scenario would cause a rebalancing of the portfolio with a tilting towards “safer” assets. As the more traditional investors have included cryptoassets in their portfolio with a diversification motive, the larger the effect.

A different channel could exist if investors think of cryptoassets as a form of tech stock whose value depends on the adoption of a specific new technology in the future. This implies that when the discount rate goes up their price goes down.

The existence of these channels ultimately depends on investors' beliefs and on how that will shape the path of adoption. However, the disconnect of cryptoassets from earnings has long motivated the belief of no correlation with macro fundamentals. What does the data say? A mixed message.

Researchers at the World Bank (Feyen et al 2022) have reported that empirical analyses suggest that cryptoasset volumes are associated with a set of forward-looking global macro-financial factors. For example, after controlling for a range of global and domestic factors, a 10-basis-point increase in monthly U.S. inflation expectations increases monthly crypto volumes by about 28 basis points. In contrast, country-level macroeconomics do not appear to be strongly related to country-level volumes.

They have also observed that cryptoassets have higher volumes when real U.S. Treasury yields are low. The latter are considered to proxy for global financial conditions. This would indicate that traders with a macro strategy have added cryptoassets to their portfolios and perceive them as risk-on assets.

Daniele Bianchi, an academic consultant at Aaro Capital, has done research on the topic and has observed that: 2

Yet, the correlation with the equity market portfolio is statistically significant for both the cryptoasset value-weighted market portfolio, the volatility factor as well as the idiosyncratic volatility risk factor. This is relevant, particularly in the context of the cryptoasset market portfolio. Indeed, this result suggest a non-trivial correlation between the two markets. Nevertheless, although significant, the multiple correlation between the crypto market portfolio and equity risks seems rather small (22% based on R2 metrics).

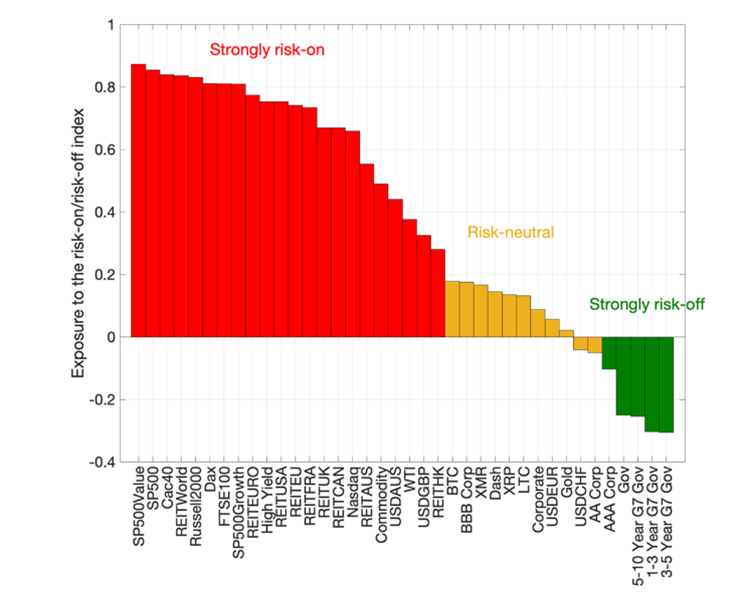

Further, Daniele reported that cryptoassets have exhibited risk-on dominance during Covid pandemic, but notes that there was not an evident trend over the whole sample period of analysis. Over the whole sample, Daniele finds that crypto and bitcoin appear to have low cyclical correlation and hence can be seen as risk neutral assets (see Figure 4).

Figure 4: Asset Correlations with the Risk-on/Risk-off Factor

Overall, the empirical evidence seems to be inconclusive.

On the one hand, if crypto is still in the earlier stages of adoption and the majority of crypto supply Is still held by “crypto believers” and early crypto adopters who have made a large proportion of their wealth in crypto, thus less impacted by macro, then one would expect to see a limited macro effect at this stage of market development.

On the other hand, the appearance of a correlation between the global money stock and crypto prices could possibly indicate that institutional and other investors have included holding cryptoassets in a portfolio along with other established assets, hence their value will be affected by global economic conditions and the monetary policy stance.

US monetary policy and the global financial cycle

The findings of Feyen et al (2022) seem to indicate that cryptoassets correlate not with national macro conditions but with US and global ones. This is not unexpected, given the global nature of the crypto market. Furthermore, shifts in US monetary policy are known to generate spillovers across global markets. In fact, several asset classes co-move globally due to both global shocks and in response to changes in risk attitude and demand triggered by US monetary policy (Rey, 2013).

As an Illustration, Figure 4 reports an empirical estimate of how tightening monetary policy in the US affects global variables. Following an exogenous interest rate hike in the US, there is a sharp adjustment in asset prices across the global economy, deterioration of financial conditions, reduction in risk appetite, and rebalancing of portfolio holdings - offloading riskier assets.

These effects are likely to be large at present when not just the Fed but all the leading central banks and many others in emerging economies are tightening their policy stance.

Figure 5 – The global effects of a US monetary tightening

Quantitative Easing and Crypto

In the years that followed the Global Financial Crisis, with the short-term rates stuck at the zero lower bound (ZLB) the Fed and other leading central banks have practiced quantitative easing (QE). QE is a policy by which a central bank purchases securities, and in particular long-term bonds, from the open market to push down interest rates and increase the money supply.

Does QE affect asset prices? Yes. Let’s think of the Fed buying $1 million in treasuries from the secondary market. The private investors that sold the treasuries may want to reinvest the cash into shares or other assets that offer better returns (and possibly higher risk). This in turn pushes up the value of several asset classes and moves investors to a higher-risk frontier.

Does QE affect crypto? Liquidity injected into the economy and looking for investment opportunities may be partially spilling over into the crypto market, especially in a risk-on environment.

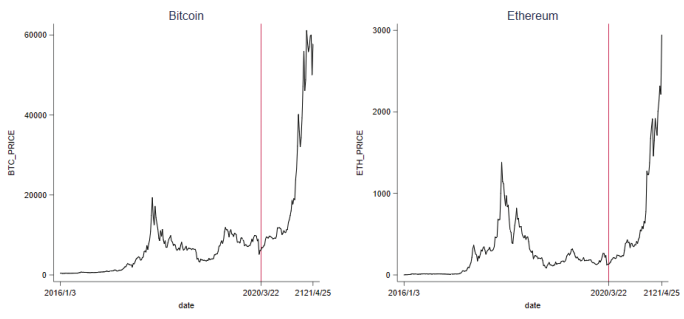

What does the data say? Some papers have claimed evidence of the effects of QE on cryptoassets. For example, Gu et al (2021) find that, following the surprise announcements of QE, the two biggest cryptocurrencies, Bitcoin, and Ethereum, have recorded significant abnormal returns (see Figure 6). However, less popular cryptocurrencies have positive abnormal returns but are not statistically significant.

Figure 6 – The effects of QE on Bitcoin and Ethereum

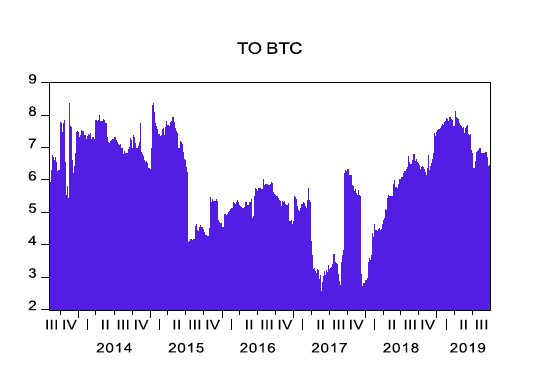

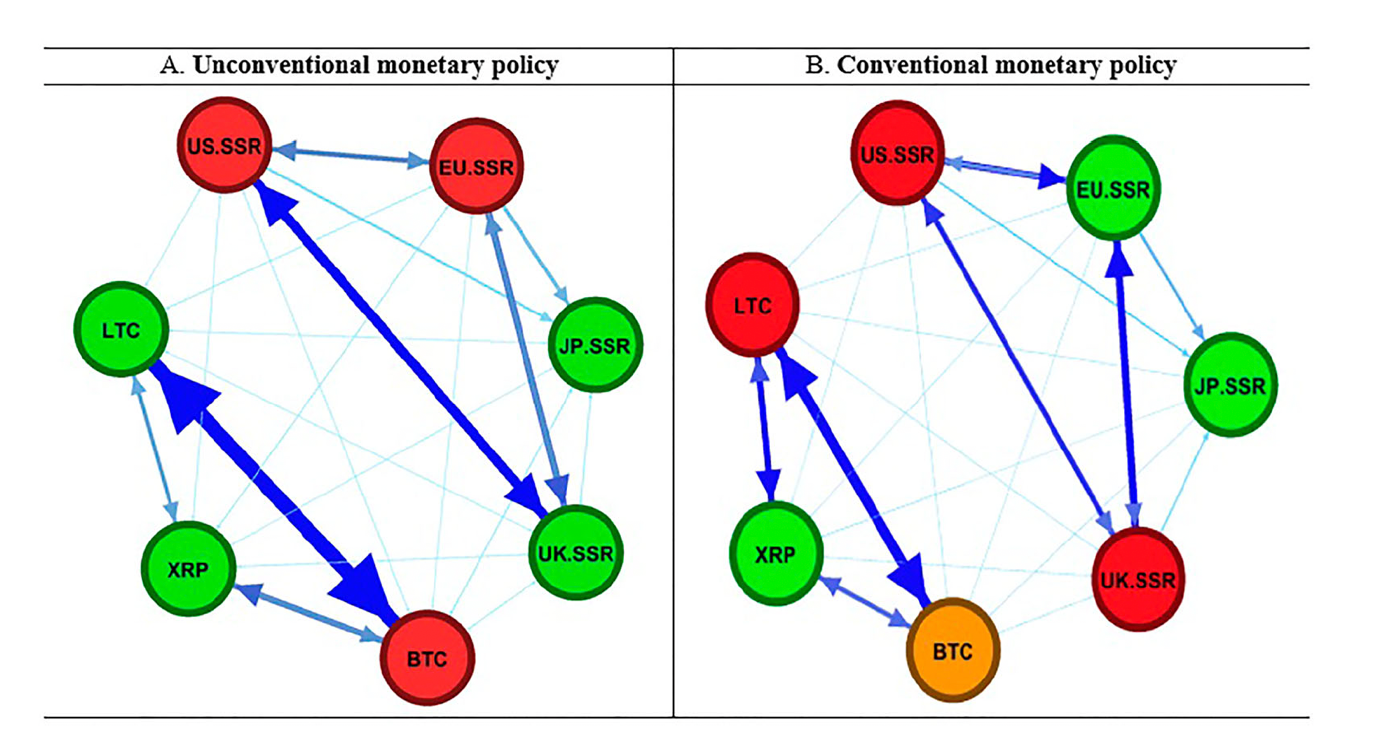

Another recent research paper, Elsayed and Sousa (2022), has analysed with a time-varying dynamic model the network of spillovers connecting the major currencies and some key cryptoassets – Bitcoin, Litecoin and Ripple, over the period August 2013 to September 2019.

Their results indicate that gross directional spillovers from monetary policy towards cryptoassets are generally muted and in the range of 2%-6% of the surprise volatility in return, throughout the sample period (Figure 7). Spillovers have a common pattern across cryptoassets: they were larger during QE, began to decrease during the Fed ‘tapering process’, and rose again mid-2018.

Figure 7 – Gross spillovers to Bitcoin

The authors analyse the network between monetary policy and cryptoasset markets, over the periods of conventional (August 2013 – December 2015) and unconventional monetary policy (December 2015 – September 2019). Results, reported in Figure 8, show that there is strong interconnectedness among cryptoassets. In particular, the net directional pairwise spillovers between Bitcoin and Litecoin are reported to be strong. However, the empirical evidence suggests that the spillovers between international monetary policy and cryptoasset returns have been, over the sample considered, weak.

Figure 8 – Gross spillovers to Bitcoin

Overall, the empirical evidence seems to indicate that QE by directly affecting the money stock may explain part of the apparent correlation observed between global M2 and crypto prices. Yet, it is probably not the main factor.

What will happen in the coming years? In the current phase of high inflation, the Fed and the BoE (the ECB may follow) have switched from QE to QT and increased the short-term rates. Quantitative tightening (QT), also known as balance sheet normalisation, means that a central bank shrinks its monetary reserves by removing government bonds from the balance sheet either selling them or letting them mature. QT’s effect on asset prices works in reverse as compared to QE.

Cryptoassets seem to have benefited in the past from QE, being possibly regarded as one of the alternative investment assets in a low-rate environment. In fact, during that period, the price of Bitcoin rose to all-time highs. With the change of stance and the arrival of QT, there is a question of whether institutional investors may withdraw liquidity with possible knock-on effects, this may become a primary diver of cryptoasset prices.

Why liquidity may matter in crypto?

Does global liquidity matter for crypto more than for other assets? There are different arguments for that. First, if cryptoassets are perceived as risk-on assets, they may be more sensitive to changes to risk attitude.

Second, cryptoassets values are sustained as long as investors expect them to be higher in the future. This increase in value must be sustained in broader terms by liquidity entering the market: either via adoption and flow of new investors that pushes expected prices up, or by an increase in liquidity due to leverage and debt in the system.

This mechanism may amplify the effects of changes to risk attitude. If liquidity conditions change and investors become more risk averse and shed bitcoins, built-in fragility in the systems such as the use of collateral for loans and leverage via fractional reserves of stablecoins may create large movements in prices due to ‘margin calls’.

Leverage is hardly new in the financial world, but generally is highly regulated following the experience of the financial crises. In the crypto market leverage can happen via collateralised loans that allow investors to borrow funds to increase potential profits, hedging or short selling. Crypto loans are typically collateralised at higher that 100% rate, often 150% to protect against volatility in prices. For example, to borrow $1 a trader must post $1.50 worth of cryptoassets. This implies that if the market contracts, borrowers may be forced to liquidate large positions due to the margin call. At market level, fire sales can further depress prices forcing further liquidations and market contraction.

This is largely the mechanism that has created turmoil among stablecoins and major crypto players (beyond bad practices and wrongdoing).

Conclusions

At the global level, asset prices and liquidity co-move due to the underlying macroeconomic shocks that affect the economy inducing synchronised rebalancing of the portfolios of global investors.

Several commentators and research pieces have noticed apparent co-movements or correlations between the crypto market and global liquidity.

However, at the present, the academic empirical analysis is rather inconclusive and may point either towards shifts in risk attitude that correlate with shifts in fundamentals/monetary policy and that spillover into the crypto market, or be an indication of cryptoassets being included in global investment strategies.

It is worth stressing that the crypto market is at present still relatively small and in a phase of development where shifts in beliefs, usage, and technology can determine even large price movements independent of macro fundamentals. Ultimately, if crypto is adopted by a large proportion of investors, crypto will likely at some stage become macro driven like other asset classes.

Bibliography

The Big Influence of Global M2 Money Supply on Crypto Markets

Martin Young – CryptoPotato 2022-07-24 11:58

https://www.binance.com/en/news/top/7157826

Where's the price of Bitcoin going? Money supply growth may give a clue

ETBitcoin USD (BTC-USD) Max Gottlich Aug. 22, 2021 1:14 PM

https://seekingalpha.com/news/3732415-liquidity-shortage-calls-for-lower-bitcoin-price

Top Macro Factors Moving the Crypto Market

Ivan Liljeqvist

https://academy.moralis.io/blog/top-macro-factors-moving-the-crypto-market

Cong Gu & Benfu Lv & Ying Liu & Geng Peng, 2021. "The Impact of Quantitative Easing on Cryptocurrency," International Journal of Economics and Financial Issues, Econjournals, vol. 11(4), pages 27-34.

Erik Feyen, Yusaku Kawashima, Raunak Mittal, “The ascent of crypto-assets: evolution and macro-financial drivers”, April 2022

https://blogs.worldbank.org/developmenttalk/ascent-crypto-assets-evolution-and-macro-financial-drivers

Gu et al (2021), “The Impact of Quantitative Easing on Cryptocurrency”, International Journal of Economics and Financial Issues, 2021, 11(4), 27-34.

Rey, Helene (2013). “Dilemma not trilemma: the global financial cycle and monetary policy independence,”Technical report, Proceedings- Economic Policy Symposium- Jackson Hole.

Riccardo Degasperi, Hong, Seokki Simon, Ricco, Giovanni, 2020. "The Global Transmission of U.S. Monetary Policy," The Warwick Economics Research Paper Series (TWERPS) 1257, University of Warwick, Department of Economics.

Sims, Christopher A. (2012). "Statistical Modeling of Monetary Policy and Its Effects." American Economic Review, 102 (4): 1187-1205.

William Quinn, “Why are cryptocurrencies crashing?”

https://www.economicsobservatory.com/why-are-cryptocurrencies-crashing

Lewis McLellan, “Crypto margin call must wake up regulators”, June 2022

https://www.omfif.org/2022/06/crypto-margin-call-must-wake-up-regulators/

Ahmed H. Elsayed & Ricardo M. Sousa (2022) International monetary policy and cryptocurrency markets: dynamic and spillover effects, The European Journal of Finance, DOI: 10.1080/1351847X.2022.2068375

Footnotes

1 We discuss “Crypto and the Pricing of Risk” in a separate article

https://en.aaro.capital/Article?ID=6f4c9efd-309b-4330-bdf2-c431f201bf42

2 Daniele Bianchi, “Equity and cryptocurrency risk factors”

https://en.aaro.capital/Article?ID=283a30ad-547d-421f-aa5e-4bed9b4af45d

3 See, for example

https://digiconomist.net/bitcoin-energy-consumption

Disclaimer