Unstable Stablecoins

May 2022 saw serious turbulence building up in the crypto market. Stablecoins were the epicentre of the turmoil, with the collapse of TerraUSD (Figure 1) sending shock waves across the market and price tensions which resulted in the of the pegs of several other stablecoins breaking, with DEI trading at a low of 38.23 cents on the 31st of May, and even Tether tumbling as low as 95.11 cents.

Figure 1 – TerraUSD Crashs

These events have showed crypto activists that pegs can snap, and convertibility arrangements can be broken. Yet this is nothing new in the economic history: currency and banking crises are well known and not infrequent occurrences that includes the collapse of different types of policies that involve convertibility at fixed prices.

The crash of TerraUSD has been compared to the currency crises in advanced and emerging economies. For example, the crash out of European Exchange Rate Mechanism of the British Pound in 1992, or the currency devaluation of the Mexican Peso in 1994.

In this article we review the new and old facts on fixed-price and convertibility arrangements and how they can be broken.

Stablecoins and algorithmic stablecoins

Stablecoins are cryptocurrency designed to maintain a stable value vis-a-vis an official currency or a basket of assets. They occupy a pivotal position in the crypto and DeFi, allowing fast transaction and payments between cryptoassets and traditional fiat currencies and assets, while holding a stable value. In their absence investors would have to deal with inefficient and slow transaction and exchange rate risks due to the crypto market volatility. The increasing important role of stablecoins is visible in the spectacular growth they have enjoyed in the past two years – stablecoin grew to a market cap of $159.5 billion with five stablecoins (Tether, USD Coin, Binance USD, Dai and TrueUSD) enjoying market caps above $1 billion (and a sixth one close to that figure).1

The stabilisation mechanism is the defining feature of all stablecoin initiatives. Its typology determines under which conditions the value can be maintained. There are two overarching types of stabilisation mechanisms. Stablecoins can be either:

• Backed by assets and usually a portfolio of `tokenised funds’, i.e. liquid funds such as commercial paper and/or traditional assets (or `off-chain collateralised stablecoins’), and/or cryptoassets (or `on-chain collateralised stablecoins’) held either in a centralised or in a decentralised manner.

• Unbacked or algorithmic stablecoins where expectations about the future purchasing power and some stabilisation protocol are used.

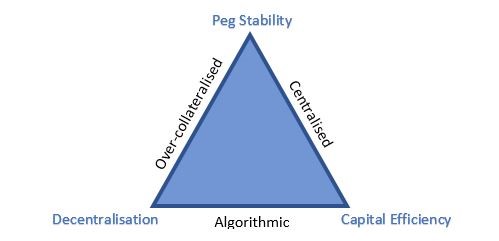

Around these arrangements there are complex ecosystems and protocols that allows the performance of a series of tasks such as token issuance, reserve asset management, transfers and an interface with end customers. Yet, whether backed or unbacked and centralised or decentralised, stablecoins all live on different edges of the stablecoin trilemma (Figure 2).

The most common stablecoins like Tether are centralised and have some degree of backing which includes commercial paper and risky assets.2 The higher the collateral margin, the safer the peg but the less capital efficient the project is. If fully backed, the same value that is issued in stablecoins has to be immobilised in liquid assets (see Garratt et al 2022). Over-collateralisation in cryptoassets and decentralisation, as for MakerDAO’s DAI, can guarantee sufficient funds to defend the peg in face of the large volatility of crypto markets but increases the degree of inefficiency (and large fluctuations can still entail risks). Algorithmic stablecoins that are under-collateralised, as TerraUSD, can be capital efficient but the stability of the peg can be threatened by speculative attacks – as history shows (see also Chaudhary and Viswanath-Natra, 2022).

Figure 2 – The stablecoin trilemma

Algo stablecoins and the case of TerraUSD

TerraUSD was designed as an algorithmic stablecoin, pegged to $1 USD through a simple arbitrage mechanism and supported by Luna, Terra’s native staking token.3 The Luna token was designed to pay fees for validating transactions on the blockchain, staking tokens in governance decisions, as well as be used independently as for example on DeFi lending protocols. More importantly, Luna had to absorb volatility from the Terra ecosystem by always allowing trades of $1 worth of TerraUSD against $1 of Luna. In simple terms, there is in place a see-saw arbitrage mechanism: if demand for UST goes up, more UST is created, and LUNA is burned, and vice versa.

To make the concept clear, consider the case where the TerraUSD price is above parity with the USD. An investor can sell $1 worth of the native token Luna and buy TerraUSD for $1. They can then sell TerraUSD in the secondary market to make a profit. Vice versa if TerraUSD is below the peg, one could make profits by buying TerraUSD at the exchange and sell TerraUSD for $1 worth of Luna tokens.

The mechanism was obviously not exempt from risks – it was backed by thin air, as the FT put it4 –, given that Terra was under-collateralised and ultimately the peg was backed by expectations of the future value of the Luna token. When Luna’s bitcoin reserves were at their peak of $1.8 billion in early May, they covered up approximately 10% of the TerraUSD market cap of approximately $18 billion. If investors had to lose faith in Luna maintaining their value in the future, nothing could have prevented its full collapse. In fact, the Bitcoin reserves became fully depleted as they were sold off to defend against a speculative attack on 10th May 2022 and the peg snapped, as had happened to many currency pegs before it.

Ultimately, algo stablecoin devaluations are not different from those of pegged fiat currencies throughout modern history. When markets realise that there is a lack of actual reserves to back the currency, speculators can short it to break the peg.

Are stablecoins entirely new objects?

No, despite the fact that this may sound surprising to some in the crypto community, stablecoins are not too dissimilar from (i) fractional bank deposits, (ii) historical private bank notes, or (iii) unilateral currency pegs.

Without a one-to-one backing in liquid assets, one can easily compare stablecoins to fractional banking. Banks take deposits and promise redemption into traditional cash at fixed value. If many holders want to withdraw their money at the same time, a bank run happens, and the bank will not have enough liquid assets to fulfil its commitments and could collapse. This is the reason for the existence of both a regulatory framework on capital requirements and a public deposit insurance. The same is true for digital stablecoins if the issuer holds risky assets that Is not sufficiently liquid or drop in value, then the peg would not hold in face of large sudden withdraws.

An even more obvious comparison are the private bank notes, as those issued during the Free Banking Era in the United States (see The Economist, 2021). During that period banks could issue their own banknotes, backed by assets and redeemable for gold or silver. Lacking a regulatory framework, the credibility of the issuers and the assets backing them were difficult to assess. Consequently, private banknotes could trade at a discount or drop in value.

Finally, thinking of stablecoins as a form of unilateral currency pegs, in which usually a national government sets a specific fixed exchange rate for its currency against a foreign currency. Similarly, a stablecoin pegging to a currency gives a stable exchange rate as long as the peg is support by sufficient reserves to defend the policy.

How a currency peg snaps and banks fail

Both currency and banking runs are attacks on price-fixing policies (see Marion, 1999). In one case, speculators infer that the government cannot maintain the fixed price for foreign currency and short the currency. In the other, depositors believe the banks cannot maintain the fixed price between deposits and currency and rush to withdraw their deposits before the conversion rate is abandoned.

Both types of events occur when the fixed-price scheme is supported by a finite stock of assets, and they end with the assets of the government, or the bank being depleted.

The economic literature has pointed to the fact that these crises may be due to predictable outcomes of inconsistencies in the peg with the fundamentals, or the unpredictable outcome of sudden shifts in market expectations.

In the first scenario, a predicted shortfall in the assets backing the nominal commitment leads to the inevitable collapse of the fixed-price promise. In such a scenario, a crisis is the outcome of rational agents who observe the inconsistency between the nominal commitment and the available resources and try to profit from dismantling the fixed-price commitment.

In the second scenario, an unpredictable shift in market expectations triggers a shift between the possible multiple equilibria sustained by beliefs and ultimately a crisis. When the markets start doubting the government's commitment to the fixed exchange rate, the government may decide to abandon the fixed exchange rate and validate market expectations. Alternatively, when the markets become more pessimistic about the bank's commitment to its fixed price for currency in terms of deposits, it can trigger a bank run that confirms people's fears. In both cases, beliefs are shaped by more than the assets directly backing the fixed price policy. Runs are characterized by a panic atmosphere in which agents queue up to acquire international reserves or bank assets according to a "first-come-first-served" criteria.

Conclusions

The economics of stablecoins and how pegs can break is not new. The history of bank and currency crises offers wisdom to crypto markets and points to the fact that both crises of fundamentals and trust are possible for stablecoins. Ultimately, only the existence of sufficient reserves and sufficient resolve to defend the peg can guarantee the survival of stablecoin arrangements that are put to test by markets.

Yet trade-offs are not trivial. Stablecoins that do not tie up sufficient liquidity are risky and less trustworthy. The more liquidity is available in reserves, the safer the peg and the stablecoin. However, as the scalability trilemma highlights the higher the percentage of reserves immobilised in liquid assets, the less efficient the capital allocation is.

Bibliography

Rod Garratt, Michael Lee, Antoine Martin, and Joseph Torregrossa, “The Future of Payments Is Not Stablecoins,” Federal Reserve Bank of New York, Liberty Street Economics, February 7, 2022

https://libertystreeteconomics.newyorkfed.org/2022/02/the-future-of-payments-is-not-stablecoins/

Alex Moskov, “Terra (UST and LUNA) Guide: Is Terra Legit and How Does It Work?”

https://coincentral.com/terra-guide-ust-luna/

Shaurya Malwa, “Fantom Stablecoin DEI Becomes Latest to Lose Dollar Peg”

https://www.coindesk.com/markets/2022/05/16/fantom-stablecoin-dei-becomes-latest-to-lose-dollar-peg/

Amit Chaudhary, Ganesh Viswanath-Natra, 2022, “Algorithmic stablecoins and devaluation risk”

https://voxeu.org/article/algorithmic-stablecoins-and-devaluation-risk

The Economist, `The explosion in stablecoins revives a debate around “free banking”’, 4 December 2021

https://www.economist.com/finance-and-economics/2021/12/04/the-explosion-in-stablecoins-revives-a-debate-around-free-banking

Nancy Marion, 1999, “Some Parallels Between Currency and Banking Crises” in International Finance and Financial Crises: Essays in Honor of Robert P. Flood Jr. (pp.19-23), Kluwer Academic PressEditors: Peter Isard, Assaf Razin, Andrew Rose

Douglas Arner, Raphael Auer and Jon Frost, 2020, “Stablecoins: risks, potential and regulation”, Bank of International Settlements

Footnotes

1 As on the 7th June 2022, see www.coinmarketcap.com

2 Tether, the largest single stablecoin issuer, with $74bn in tokens in circulation, was fined $41m by the Commodity Futures Trading Commission in October for misrepresenting itself as fully backed by assets between 2016 and 2019.

3 See the very good article of Alex Moskov, “Terra (UST and LUNA) Guide: Is Terra Legit and How Does It Work?” https://coincentral.com/terra-guide-ust-luna/

4 Bryce Elder, “Runtime error: stablecoin not found”, 10 May 2022

https://www.ft.com/content/83df00c8-c95f-497b-bf17-2c3f6816b019

Disclaimer