The Future Monetary System

In its highly influential Annual Economic Report, released in June 2022, the Bank of International Settlements (BIS) has proposed a vision of what a monetary system based on Central Bank Digital Currencies (CBDCs) could look like.

CBDCs are a digital payment instrument denominated in the national unit of account, which sit on the balance sheet and are direct liabilities of the central bank, like cash or bank reserves. CBDCs are largely seen as the response from central banks to the transformation of payment systems brought about by cryptocurrencies and stablecoins that have shown the potential of distributed ledgers and tokenisation of assets and shaken the old financial world.

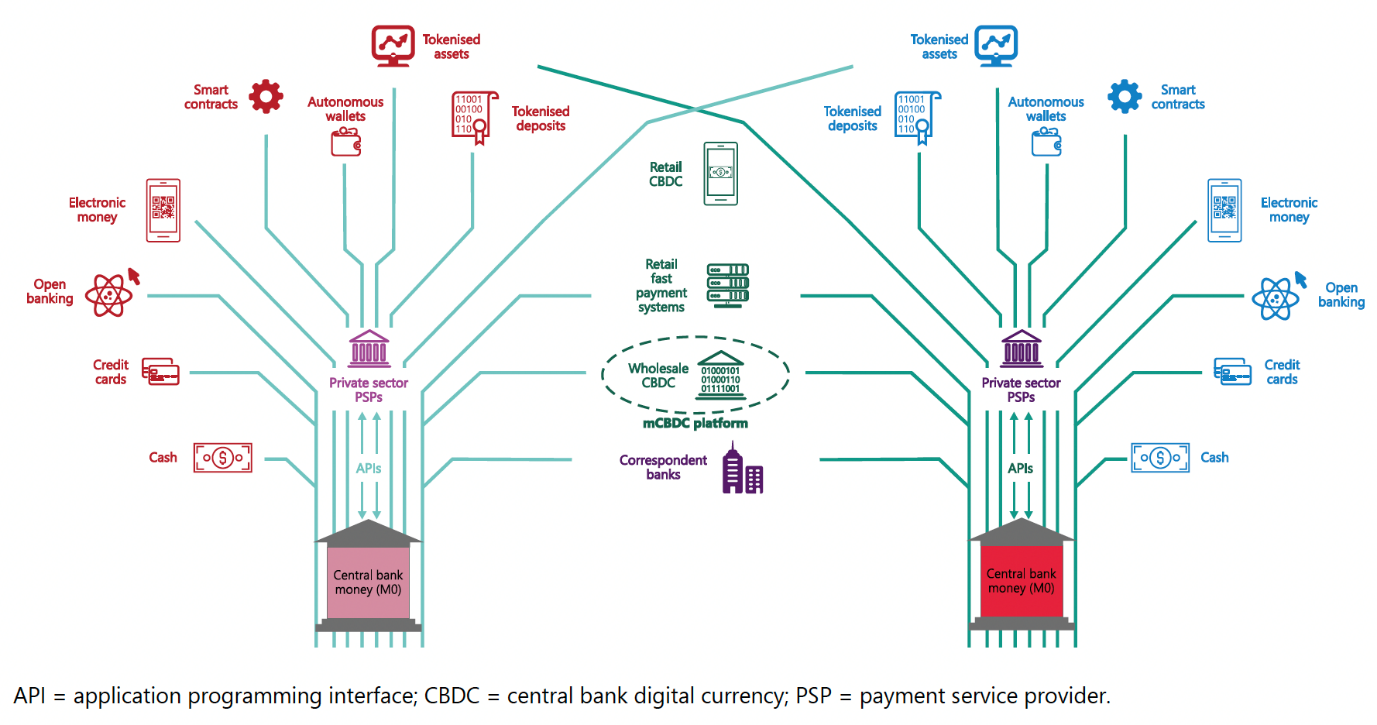

Figure 1 – The Money Tree

The BIS' vision is represented by a money tree (Figure 1) with the roots and trunks provided by central bank money in different physical and electronic forms. This supports an ecosystem of competing private sector Payment Service Providers (PSPs) and other services built on the programmability, composability and tokenisation features that have been developed in the crypto space. At a higher level, the tree would connect to a canopy of multi-CBDC (mCDBC) arrangements involving multiple central banks and currencies allowing for fast global payments.

Wholesale and Retail Central Bank Digital Currencies

The implementation of CBDCs is close at hand and will cause a large transformation in payment systems. A recent survey has shown that 90% of central banks are at different stages of implementation of retail CBDCs, with three live retail CBDCs and another 28 pilot projects (see Kosse and Mattei, 2021). Among those, the People’s Bank of China pilot project has already reached 261 million users. Several central banks have also created partnerships to explore multi-country CBDCs platforms. For example, Project Jura (with the central banks of Switzerland and France), Project Dunbar (with Singapore, Malaysia, Australia and South Africa), and mBridge (with Hong Kong SAR, Thailand, China and the United Arab Emirates).

CDBCs can be either retail or wholesale depending on whether it is directly accessible by households and businesses or only by a range of financial intermediaries like commercial banks or other financial institutions.

In the view of the BIS, wholesale CBDCs would allow a range of banks and non-banks to integrate themselves with the central bank. This could lead to an innovative range of services to consumers based on composable open-source applications and tokenisation.

Retail CBDCs, “digital cash”, would go further and make central bank money directly available in digital form to households and businesses. Retail CBDCs are not too dissimilar from retail fast payment systems1 (FPS, many of which are operated by the central banks) and can allow for instant payments between end users through a range of interfaces and competing private PSPs.2

A New Financial World

Why would central bank create CBDCs? The creative use of technology in the crypto space has shown the potential of new payment systems that are programmable, composable and based on the tokenisation of assets.

Composability enables a protocol to combine simpler components as building blocks of more complex system, as is the case with DeFi protocols. Programmability is another feature of DLT that allows for pre-programmed actions and automatisation. Finally, tokenisation is a digital representation of an asset as a token on a distributed ledger, allowing protocols to record ownership and execute transactions.

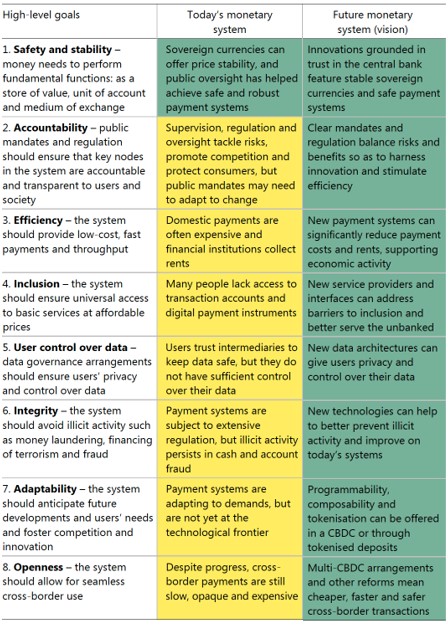

Figure 2 – High-Level Goals and the BIS Vision of a Monetary System

These properties are crypto-native and not available in the traditional centralised monetary systems. They allow an array of ever evolving services to meet the emerging needs of consumers and investors.

The BIS and central banks have been increasingly aware of the wave of technological innovation that has rapidly challenged the old financial system. CBDCs are a response to this challenge and attempt to incorporate crypto innovation into central bank money.

The BIS report provides an appraisal of this vision and of the current system using a grid of desirable properties of a monetary system, namely safety and stability, accountability, efficiency, inclusion, user control over data, integrity, adaptability, and openness (see Figure 2). When assessed against these parameters, today's monetary system has generally been stable and safe (especially in developed markets), but not fully inclusive (especially in developing markets) and lacking both adaptability and openness. Also, it is sometimes not efficient, for example, not providing cheap and fast payments, as is the case of cross-border transactions. The BIS believes that the creation of public electronic money incorporating crypto-technologies and structures could lead to improvements and help fulfil the high-level goals that the report defines.

Among other examples, CBDCs could make possible:

• The creation of open libraries of protocols that would provide building blocks for the creation of new (and personalised) financial service bundles, built on top of the programmability function of CBDCs.

• The tokenisation of deposits that would allow for a decentralised settling system and open up new forms of exchange across several records of ownership of securities and real assets.

• The tokenisation of financial instruments would enable easy transactions and even fractionalisation of these assets, around the clock, providing better access to financial markets.

• Atomic settlement – enabled by composability, programmability, and tokenisation – where two assets are instantaneously exchanged and each of them is transferred only upon the transfer of the other, making transactions safer.

• Programmable CBDCs could also allow for automated transactions. The Internet of Things could see machine-to-machine payments in autonomous ecosystems, with automated systems using allocated budgets to directly purchase goods and services from each other.

• Multi-CBDC arrangements involving multiple central banks and currencies could significantly improve efficiency and reduce costs of cross-border transactions.

• A cheaper and more inclusive financial system, reaching areas and consumers that are excluded from current banking and financial services.

Crypto and the CDBCs Environment

The money system described by the BIS sees the incorporation of crypto technology in public money. Their vision gives a key role to central bank currencies, this would still be open to challenges from new asset classes and potentially private monies. The report in fact provides a list of what it considers the most urgent regulatory changes needed to provide safety to consumers and investors when trading in crypto. In particular, it highlights four main regulatory gaps.

• First, the BIS recommends addressing cases of regulatory arbitrage, starting from the principle of “same activity, same risk, same rules”. This is to ensure that crypto and DeFi activities comply with legal requirements for comparable traditional activities.

• Second, regulators should enforce safety and integrity of the financial systems by applying Know-Your-Customer (KYC) and other Financial Action Task Force (FATF) requirements in the crypto space.

• Third, protect consumers by enforcing adequate disclosure on the risks entailed by investment in cryptoassets as in other risky assets. Furthermore, regulation on potential manipulation of the assets and the information involved in settlement, as it is the case for oracles that outsource information in DeFi contracts.

• Forth, financial stability risks that arise from the exposure of banks and non-bank financial intermediaries to the crypto space should be addressed by central banks and financial regulators.

The BIS also notes that across all areas of regulation, the global nature of crypto and DeFi will require international cooperation.

Conclusions

A wave of central bank digital currency projects around the world are striving to create a new monetary system by absorbing some key innovations native to the crypto universe. The BIS Annual Report sets out how a centralised monetary system could look like in the future. The aim is to create a modern monetary system where the potential of programmability, composability, tokenisation and DLT allow for new and efficient services to be built on an electronic form of public money that remains the pillar of the monetary system. Whether this will succeed depends on the ability of the CBDCs to truly allow for a vibrant ecosystem where innovation is encouraged to transform traditional financial services, while consumers’ privacy is preserved. In the digital economy personal data is of economic value and can even be used to manipulate and control citizens. Preserving privacy from governments and companies is a key challenge.

Bibliography

BIS, “The future monetary system” in the BIS Annual Economic Report 2022

http://www.bis.org/publ/arpdf/ar2022e3.htm

Coindesk, “CBDCs, Not Crypto, Will Be Cornerstone of Future Monetary System, BIS Says” by Sandali Handagama, Jun 21, 2022

https://www.coindesk.com/policy/2022/06/21/cbdcs-not-crypto-will-be-cornerstone-of-future-monetary-system-bis-says/

Kosse, Anneke and Ilaria Mattei (2022): “Gaining momentum – Results of the 2021 BIS survey on central bank digital currencies”, BIS Papers, no 125, May.

https://www.bis.org/publ/bppdf/bispap125.htm

Footnotes

1 Bank and non-bank PSPs provide retail-facing payment services. The key difference from retail FPS is that CBDCs would a legal claim directly on the central bank and not on an intermediary financial institution. Both retail CBDCs and retail FPS are built on a public data architecture with APIs for secure data exchange between different service provides.

2 Project Hamilton of Boston Fed and the MIT has shown that a CBDC architecture can process 1.7 million transactions per second, more than the current major card networks or blockchains.

Disclaimer