The Bitcoin network is maintained by miners, who keep a copy of all previous blocks of transactions and compete to write new blocks, in order to earn transaction fees and newly created coins. In this report, we examine the cost of maintaining the network and its relationship with the hash rate and price of bitcoin. Moreover, we describe under what cost scenarios miners are profitable, their geographical distribution, and how clean their energy consumption is.

Introduction

The miners in the Bitcoin network use the Proof-of-Work protocol. This protocol determines, every 10 minutes, which miner gets the right to write the next block of the blockchain. The winning miner earns the bitcoin transaction fees and the reward of 6.25 newly minted bitcoin. Currently, the fee-to-reward ratio, i.e. the ratio between bitcoin fees vs newly minted bitcoin earned by a miner, is around 3%, down from 5% in 2018 and 16% in 2017. The decline is more pronounced given that the reward of the newly created Bitcoins halves every 210,000 blocks.1

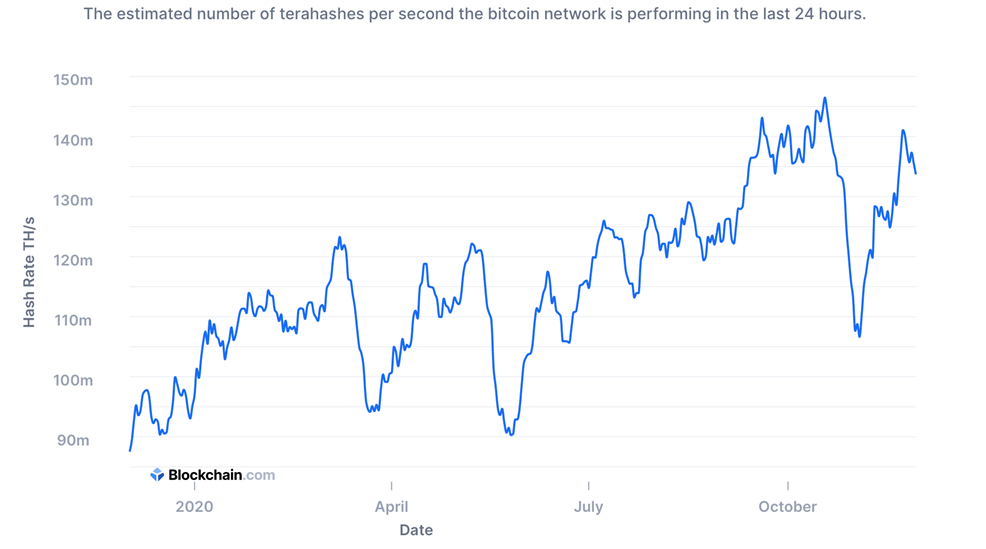

The Proof-of-Work protocol selects the miner who first solves a difficult mathematical problem, which can only be solved by repeatedly guessing and testing whether different numbers satisfy a particular maths equation. The more calculations a miner can perform per second (also called the hash rate), the sooner they can find an acceptable solution, and the higher the probability that they will be the first to broadcast this solution. Because a new block needs to be created on average every 10 minutes, the difficulty of the maths problem is periodically adjusted, so that the total hash rate of the network is enough for the miners to solve it within that timeframe. This means that the total hash rate is a measure of how many miners are competing within the network, as well as the electricity required to solve the problem.

There is an intricate relationship between the total hash rate, the cost of electricity and computers, and the price of bitcoin. An increase in the marginal cost of electricity and computers disincentivises miners to keep maintaining the network, unless the price of bitcoin increases accordingly. If the price of bitcoin increases, more miners enter the network. The increased competition drives up the total hash rate and the total amount of money spent on electricity and computers. However, a high hash rate, and accordingly a high price for Bitcoin, means that it is very difficult to attack the network and falsify the transactions, for example using the 51% attack.2

How much electricity is required to run the entire Bitcoin network? The December 2019 update of the “The Bitcoin Mining Network” estimates the total electricity draw of the entire Bitcoin mining industry in November 2019 to be around 6.7 gigawatt (GW), a 43% increase from June 2019.3 On an annualised basis, this works out to 61 terrawatt-hours (TWh). To put this into perspective, the figure is around 7% of the electricity consumed by the aluminium smelting industry.

Is this electricity “wasted”? Analogously, is the cost of running the Bitcoin network too high? The argument goes that, since the outcome of Proof-of-Work is “just” to randomly pick one miner who will write the new block, nothing tangible is produced and therefore this activity is wasteful. However, this argument misses the point that it is the value of the network, through the price of Bitcoin, that drives the cost through the competition of the miners, and not the other way around. Moreover, we know that randomly picking the winner would lead to a Sybil attack and a collapse of the network, hence Proof-of-Work also produces a stable and secure decentralised network, which has never been compromised in the case of Bitcoin. On the other hand, there are other algorithms, such as Proof-of-Stake, which aim to provide the same level of stability and security, without using any electricity. However, Proof-of-Stake has not been as thoroughly tested as Proof-of-Work yet.

Figure 1: Total Hash Rate (TH/s)

Are Miners Profitable?

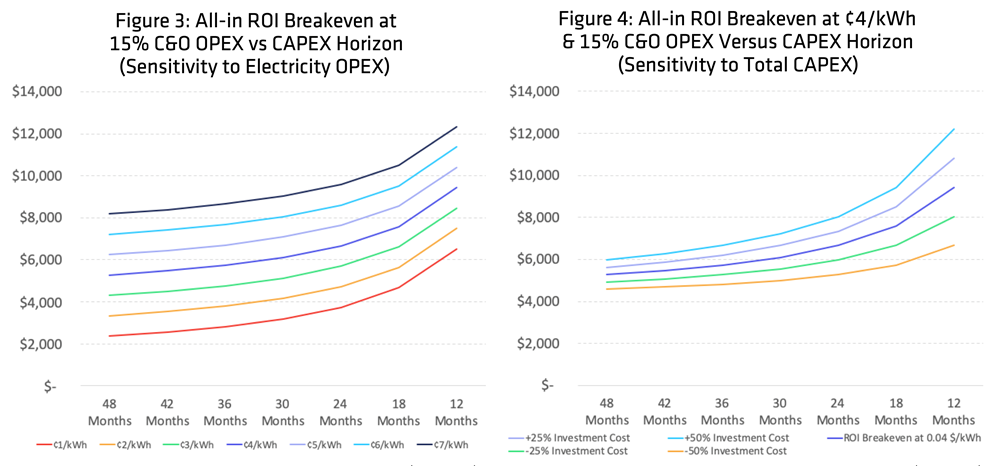

The December 2019 update of the “The Bitcoin Mining Network” estimates that the market-average, all-in marginal cost of creation of one bitcoin is approximately $6,100. This is calculated using the following assumptions: a $0.04/KWh electricity cost, non-electricity operating expenses (OPEX) accounting for 15% of the total cost and a 30-month depreciation schedule. At a current price of around $18,000-$19,000 in early December 2020, miners are definitely profitable. In fact, miners are profitable under any of the scenarios contemplated by the report. The worst-case scenario, for example, estimates a cost of creation of around $15,000 per Bitcoin, assuming a $0.07/KWh electricity cost, 15% non-electricity operating expenses and 12-month depreciation schedules.

Another important measure for the sustainability of the current stock of miners is the cashflow breakeven level. If the price of Bitcoin falls below the breakeven level, the average miner will start shutting down their operations. Under the scenario of $0.04/KWh electricity cost, 15% non-electricity operating expenses and 30-month depreciation schedules, this level is $3,900, whereas at $0.07/KWh it is $6,800.

Figure 2: All-In ROI Breakeven Bitcoin Price

China is the world leader in Bitcoin mining, as it accounts for around 65% of the Bitcoin hash rate. The Sichuan region alone produces around 54% of the hash rate, with the remaining hash rate split between the Yunnan, Xinjiang and Inner Mongolia regions. Outside of China, the main Bitcoin miners in Sweden, Russia, Kazakhstan, Norway, Georgia, Iran and the US.4

China has an ambivalent stance towards the cryptocurrency ecosystem. On the one hand, it is the home to some of the largest mining hardware manufacturers, such as Bitmain. On the other hand, cryptocurrency exchanges and coin offering projects are in principle banned in the mainland and the use of bitcoin is banned for retail transactions and by financial institutions.

Even though China is the global leader of Bitcoin mining, the Chinese government is not particularly supportive of the industry, at least officially. In April 2019, the Industrial Structure Adjustment Guidance Catalog, published by the National Development and Reform Commission (NDRC), described Bitcoin mining as an undesirable industry that needs to be gradually phased out. However, this reference was deleted in November 2019. Moreover, the Chinese government has not actively banned miners and indirectly has cooperated, for example by allowing mining farms to buy energy from state-owned hydropower plants in Sichuan.5

The big advantage of China is its ability to produce electricity at a very low marginal cost, hence it has a comparative advantage in producing bitcoin. However, the most important reason why China is not completely dominating the Bitcoin mining industry is the regulatory uncertainty. Because the Chinese government can very easily change its stance towards Bitcoin mining, miners are more willing to invest in countries with a higher electricity price but with a more stable regulatory framework, such as Sweden and the US.

The Energy Consumption of Bitcoin Mining

According to the December 2019 update of the “The Bitcoin Mining Network”, around 73% of the energy required to run the Bitcoin network is produced using renewables. This figure makes the Bitcoin mining industry one of the greenest in the world. Moreover, the biggest part of renewables consists of hydroelectric power. A prime example is Sichuan, where almost all of the hash rate is produced using hydroelectric power.

The importance of using hydroelectric power to produce bitcoin is twofold. First, it is a clean form of energy. Second, bitcoin mining does not crowd out other activities that compete for the same type of energy. During the rainy season in Sichuan, hydroelectric plants produce excess electricity, that cannot be stored and would go to waste if there was not sufficient demand. Bitcoin miners plug this hole by consuming the excess electricity. As a result, hydroelectric plants become more efficient, with more predictable revenue streams and higher profits. This, in turn, can lead to increased investment in renewables, which can accelerate the global effort to move away from non-clean forms of energy.6

Conclusion

There is a widely held misconception that the electricity cost of maintaining the Bitcoin network is too high and that Proof-of-Work is wasteful because it does not produce anything tangible. We argue in this post that the cost is high only if the value of the bitcoin network is even higher, thus increasing the competition of miners to receive the rewards. Moreover, Proof-of-Work is the only algorithm, up to now, that has stood up to the test of time when it comes to providing a secure and stable decentralised network. This has thus far not been achieved by any other mechanism and was long thought to be unachievable.

Footnotes

1 See the “Bitcoin Mining Network”, December 2019 update, at https://coinshares.com/assets/resources/Research/bitcoin-mining-network-december-2019.pdf.

2 For more information on Proof-of-Work, see “An Introduction to Distributed Ledger Technology” at https://en.aaro.capital/Download.aspx?ID=b82c52e7-b8e5-42a3-a771-9fd27f8cfb4d&inline=true.

3 See the “Bitcoin Mining Network”, December 2019 update, at https://coinshares.com/assets/resources/Research/bitcoin-mining-network-december-2019.pdf.

4 Ibid.

5 See https://news.bitcoin.com/china-removes-bitcoin-mining-from-unwanted-industries-list/.

6 See https://news.bitcoin.com/how-big-hydro-power-partners-with-bitcoin-miners-to-prevent-energy-waste/.