The Ethereum Merge

This September, the $200bn market cap Ethereum platform will undergo what is the most important update since its launch in 2015. It will switch from Proof-of-Work (PoW) software to much newer Proof-of-Stake (PoS). This upgrade has fundamental implications for the security, centralisation and economics of the platform. In this post, we discuss the main benefits and risks of PoS and its future implications.

Introduction

After years of testing and many postponements, the current Proof-of-Work (PoW) Ethereum platform (Mainnet) will merge with the newer Proof-of-Stake (PoS) Beacon Chain. This merge will replace the PoW software currently used by Ethereum with the PoS. This major upgrade is commonly referred to as the upgrade to Ethereum 2.0.

Cryptocurrencies enable effective decentralised governance through intelligent economic design, something which was not previously possible. In the absence of a centralised authority who can unilaterally enforce “the rules”, a cryptocurrency’s design must ensure that it is profitable for participants to add value to a crypto platform and that it is very expensive to undermine it. A cryptocurrency’s core role, like traditional money, is to incentivise economic activity. Crypto is the next evolution of a more inclusive and ultimately democratic economy. PoW and PoS are at the very core of how cryptocurrencies achieve the economic incentives required to be secure and maintain the platforms in a decentralised and “trustless” environment.

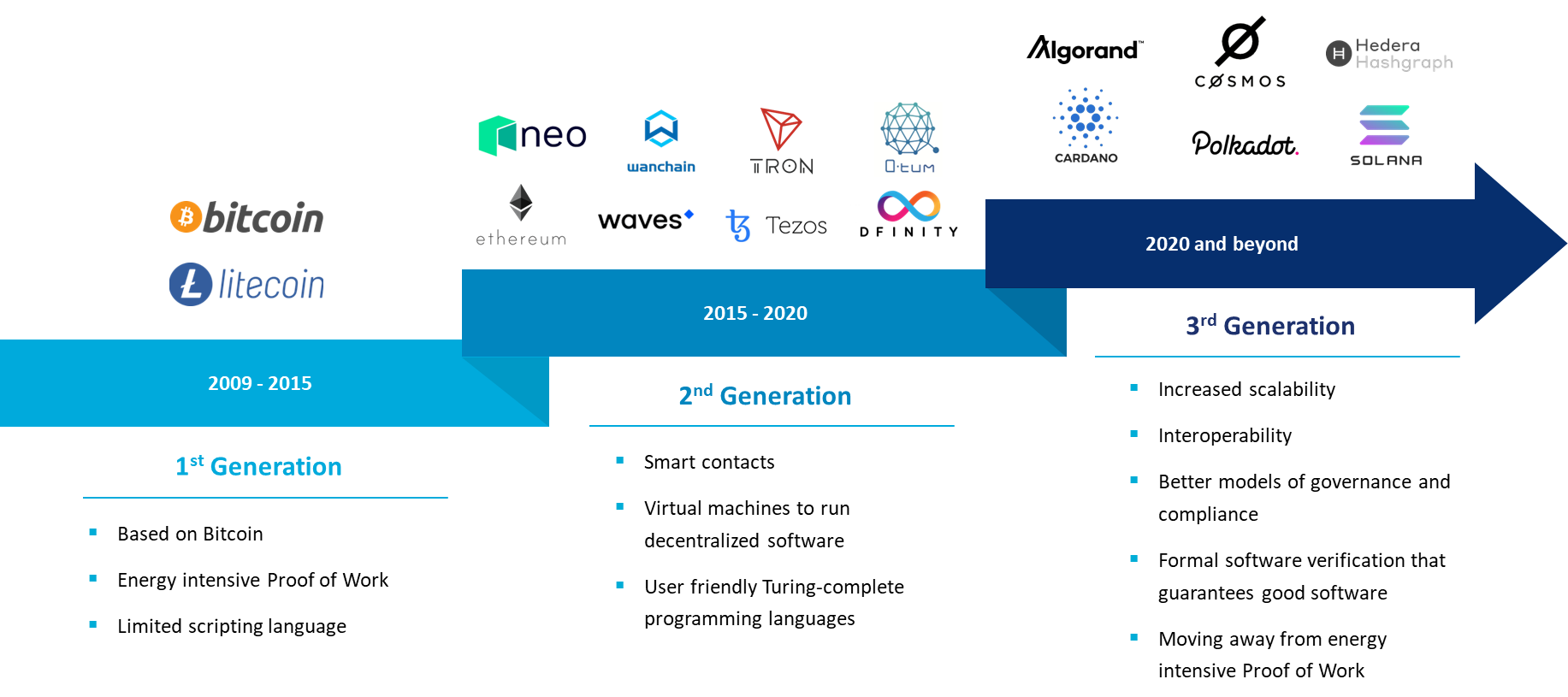

PoW is the revolutionary technology which was at the heart of the birth of bitcoin and crypto as we know it today in the depths of the 2008 Global Financial Crisis. It has been primarily used by the first-generation and second-generation crypto platforms such as Bitcoin and Ethereum. PoW has, however, been heavily criticised on the grounds that it is very resource inefficient, and even wasteful, and for having slow transaction confirmation times. Despite this, it has stood the test of time and has proven resilient to malicious attacks and, in the case of Bitcoin, has been stable for well over a decade.

Newer PoS technology is far more energy efficient in comparison, but it has not yet proven its resilience to the same extent. PoS has mainly been used by later second-generation and current third-generation crypto platforms, such as Polkadot, Cardano and Avalanche. They have notably shorter operating histories and have much smaller market caps making them a less prominent target for attackers.

History of Ethereum

Ethereum was initially conceived by Vitalik Buterin in 2013 out of the belief that crypto could be more than just digital cash, the initial vision for bitcoin. The idea of Ethereum was to become a “global decentralised supercomputer” on which decentralised applications (dApps) could be more easily developed and run. It was intended to be the base layer of the next generation decentralised web, known as Web 3.0, truly removing the need for trusted intermediaries, and counteracting the issues caused by the market power of today’s internet giants. With this innovation, Ethereum is considered the first second-generation crypto platform with its numerous innovations.

Figure 1: Evolution of Crypto

In 2014, it was crowdfunded and development work began and the first version Ethereum platform went live on 30th July 2015. The majority of the technologies still needed to be conceived and developed for Ethereum to be a “global distributed supercomputer” and become an integral part of the global economy and of the lives of billions of people. But this was the ambition of its founder, and thus began a multi-year 4 stage development roadmap.

Figure 2: Ethereum Development Roadmap

Since its launch, Ethereum has become the second largest cryptoasset by market cap behind bitcoin, valued at around $200bn as of 8th September 20221. It also has the largest developer community, the most useable applications, the most active users and the largest value of transactions on blockchain.

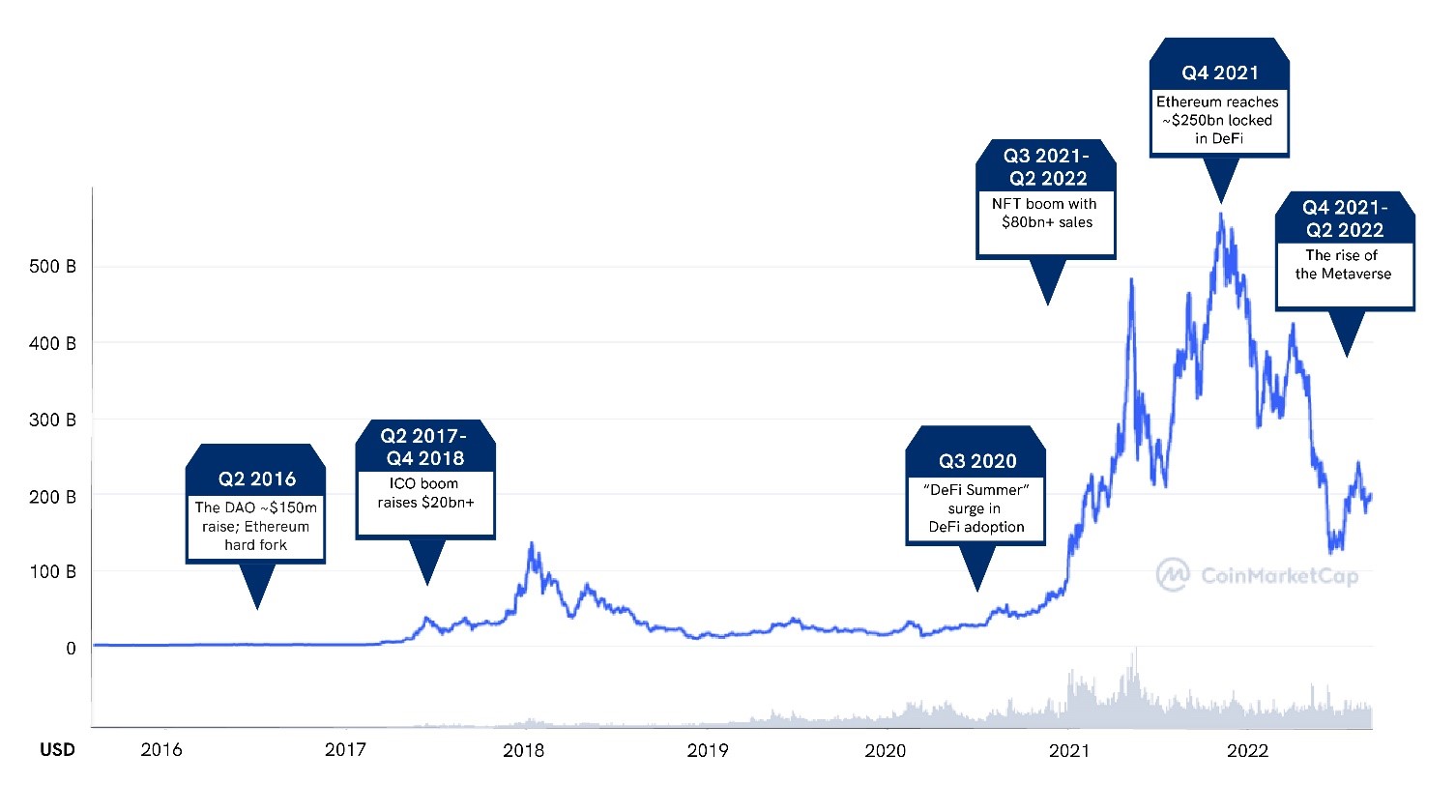

Figure 3: Ethereum Key Events

DeFi and NFTs established Ethereum’s position as the most important crypto platform after Bitcoin. However, they also created network congestion which resulted in significantly high transaction fees. This provided a market opportunity for third generation crypto platforms to gain meaningful users and developers.2

What is Proof-of-Work and Proof-of-Stake?

There is an ongoing debate in the crypto community on the advantages and drawbacks of PoW and PoS. Similar to other technologies, the winner will ultimately be determined by their success and failure over decades of real-world use.

One of the most important issues for decentralised platforms is how consensus on which transactions are valid and their correct order is achieved among the many validators who maintain and update the blockchain. Since participants do not know the identity of others, how can they communicate and agree on what information is to be written and by whom?

The easiest way of choosing the writer of the next block of transactions is to randomly pick one validator. However, this opens the possibility of a “Sybil attack”, where a participant creates multiple selves (e.g., multiple IP addresses) in order to increase their probability of selection and thus gaining the resulting transaction fees. If a participant greatly increases their probability of selection, they can control the blockchain for their own benefit, to the detriment of everyone else. The PoW and PoS protocols are solutions to this problem and are therefore called “Sybil resistance mechanisms”. They generate scarcity of resources, making it increasingly difficult and expensive for a participant to create multiple selves.

The PoW protocol achieves resistance by selecting the participant (miner) who can first solve a difficult (and costly in terms of computation) problem. When a miner finds a solution, they create a new block of transactions allocating the reward (newly minted coins and miner fees) to themselves and broadcast the new block along with their solution to the wider network of miners. Other miners can instantly verify the solution, and thus verify if the miner has done the required work and incurred the associated cost to solve the problem.

PoS makes the probability of selection proportional to the validator’s stake of cryptocurrency. A validator can be anyone who locks their coins in a deposit. PoW miners commit their computational power, whereas with PoS, validators commit their coins. As a result, staked coins are assets that can yield interest. There are several proposed methods of selecting who is entitled to write the new block among the set of all validators. In chain-based PoS, the protocol randomly selects the winner, usually with the probability being proportional to the size of each validator’s stake.

The role of both PoW and PoS is to choose which transaction validator will validate the next block of transactions to the blockchain, in a way that rewards the validators (which can be anyone and who are not automatically trusted) for maintaining the network’s security and punishes malicious behaviour.

The two systems use different economic incentives to punish bad actors who do not follow the rules for valid transactions. In PoW, if an incorrect or fraudulent block of transactions is produced, other validators are incentivised to ignore it. This means that the fraudulent miner will have wasted the large electricity and computer hardware cost for no reward. In PoS, a validator who goes offline or creates an incorrect block of transaction may face the penalty of forfeiting a proportion of their staked cryptocurrency.

Benefits of Proof-of-Stake

PoS is commonly said to solve many of the limitations of PoW based crypto platforms, namely:

1. Enabling quick or near instant transaction confirmations

2. Increased scalability of the underling blockchain via more transaction per section

3. Lower energy consumption and thus less environmental impact

4. Lower running costs due to the reduce energy consumption and computer equipment costs

For the Ethereum platform, the main immediate benefit of PoS will be the reduction in electricity consumption by almost 99.95%.3,4 This is significant not only for environmental reasons but also because it can increase adoption. Companies, developers and institutional investors who have so far stayed away from crypto due to environmental concerns, may be incentivised to reconsider engagement. This may lead to new applications on Ethereum and increase demand for its services. On the supply side, many holders of the cryptocurrency may choose to stake their Ether and earn an interest rate. This is similar to earning an interest in a bank account if done via an intermediary with the technical knowhow. This reduces the liquid supply of Ether.

Furthermore, PoS is cheaper to run and maintain. Because it does not require validators to incur the high costs associated with cryptocurrency mining, less issuance of Ether is required to incentivise them to maintain the network as compared to PoW, which implies a lower inflation rate for Ether, ceteris paribus.

However, the Merge will not make Ethereum quicker or cheaper overnight, because PoS does not automatically increase the network’s maximum transactions per second or reduce network transaction fees. It is, nevertheless, very important as it paves the way for implementing sharding. Sharding is one of the new technologies in development to help scale the number of transactions per second on Ethereum by many orders of magnitude and help reduce fees. These upgrades are currently expected to be implemented in 2023.

In combination, these updates to Ethereum will make it more technologically competitive with newer third-generation platforms, whose main competitive advantages are currently speed and throughput. Ethereum however, hopes to achieve these benefits in a more decentralised manner to many of the current third-generation platforms. These updates are likely to be required for Ethereum to remain the dominate platform for crypto in the medium to long-term.

Risks of Proof-of-Stake

PoS was first implemented in a live blockchain in 2013 but has so far not been used in large market cap blockchains for long periods of time like PoW. Further, there are many different designs for this broad family of protocols, with varying advantages and drawbacks. The Ethereum PoS Beacon Chain has been around since December 2020 and has been tested extensively in the real world. This is, however, still a short period of real world testing relative to PoW and so there is comparatively less evidence for its resilience, both operationally and in terms of withstanding attacks.

Moreover, changing from PoW to PoS while keeping the blockchain online is a huge undertaking. Many use the analogy of replacing the engine of a car while driving it. There have been three successful test upgrades, which mirror the real-world code and process required, but there can always be unexpected issues in the final upgrade. Once the upgrade is live, as with any live software, there may be unknown code bugs and vulnerabilities which may cause issues and possibly be exploited by bad actors. The final and ongoing test for any software is long-term real-world use and ongoing fixes to any issues which are discovered.

However, things are more complicated here because Ethereum is the base platform on which an entirely new Web 3.0 software infrastructure stack has been built. There is a large ecosystem of software applications and protocols that need to remain compatible with these upgrades, many of which are decentralised. Some software may fail or suffer from attacks as a result of new software issues or glitches, which may have wider implications for the Ethereum ecosystem.

Scammers may also try to defraud unsuspecting users. After this update there will be two blockchains, the new PoS one that the vast majority users and developers will follow and the old PoW one. Everything, all user’s NFTs and cryptocurrencies will exist on both, and this could be exploited. An example of this is the replay attack, where a transaction to sell assets in the PoW chain is replayed by a scammer in the PoS chain, resulting in the user losing their assets in both.5 The bigger risk is that if the PoS chain does not work as intended, some users and developers may switch back to the PoW chain, and the parallel existence of both chains for too long may create confusion and be detrimental for Ethereum.

There are two important risks for PoS: centralisation and inequality.

Currently, a validator needs to stake at least 32 Ether, which at current prices are worth around $50,000. This excludes most retail investors from directly becoming validators, reducing the potential for decentralisation. There are, however, diminishing benefits to decentralisation beyond a certain point. Most in the crypto community believe that Ethereum staking should be sufficiently decentralised 6. The fundamental design of PoS could increase inequality, however, as those who initially hold the majority of coins will earn the highest share of new coins.

This issue is partly solved by staking pools and managed staking series, such as Lido, that allow small retail investors and those with limited technical knowhow to indirectly take part in Ethereum staking via trusted intermediaries. However, this again creates the problem of centralisation. If a small number of these staking services control the majority of staked Ether, then they could control and exploit the entire Ethereum blockchain for personal gain.7 PoW also suffers from similar centralisation risks via mining pools, which in many ways is a similar concept. It remains to be seen whether PoS Ethereum will be more or less centralised than PoW Ethereum.

The final consideration is around the technicalities of how malicious actors can coordinate control of a blockchain and exploit it for personal gain to the detriment of other users. It is argued that in some circumstances PoS is cheaper to attack and requires fewer validators to coordinate, relative to bitcoin style PoW. However, given the scale of Ethereum, the costs involved in an attack would still likely be prohibitive for all but the largest entities globally, such as the largest governments and companies.

Conclusion

The Merge is the most important upgrade in Ethereum’s development and one of the most significant events in crypto base layer development. By massively reducing the electricity consumption and need for computer hardware, it will directly address one of the most prominent concerns institutions have around crypto.

Much of the mainstream investment community still focus and base their views of crypto on the bitcoin platform. The media attention around the Merge will help highlight to mainstream investors the existence and proliferation of newer and better technologies in the crypto space. This will help move the narrative on from the limitations of bitcoin, many of which have now been mitigated via newer technologies and solutions.

By paving the way for sharding in 2023, the Merge will help enable scaling. It is a technology still under development, but the hope is that it will scale the platform’s throughput by many orders of magnitude in a more decentralised way. If successful, this could become a core technology of the next generation, decentralised Web 3.0, and be running behind the screens in a large number of everyday internet enabled use cases. The Merge and Sharding are currently at the core of Ethereum’s roadmap to truly becoming the “world’s distributed supercomputer” and an integral part of the global economy and of the lives of billions of people.

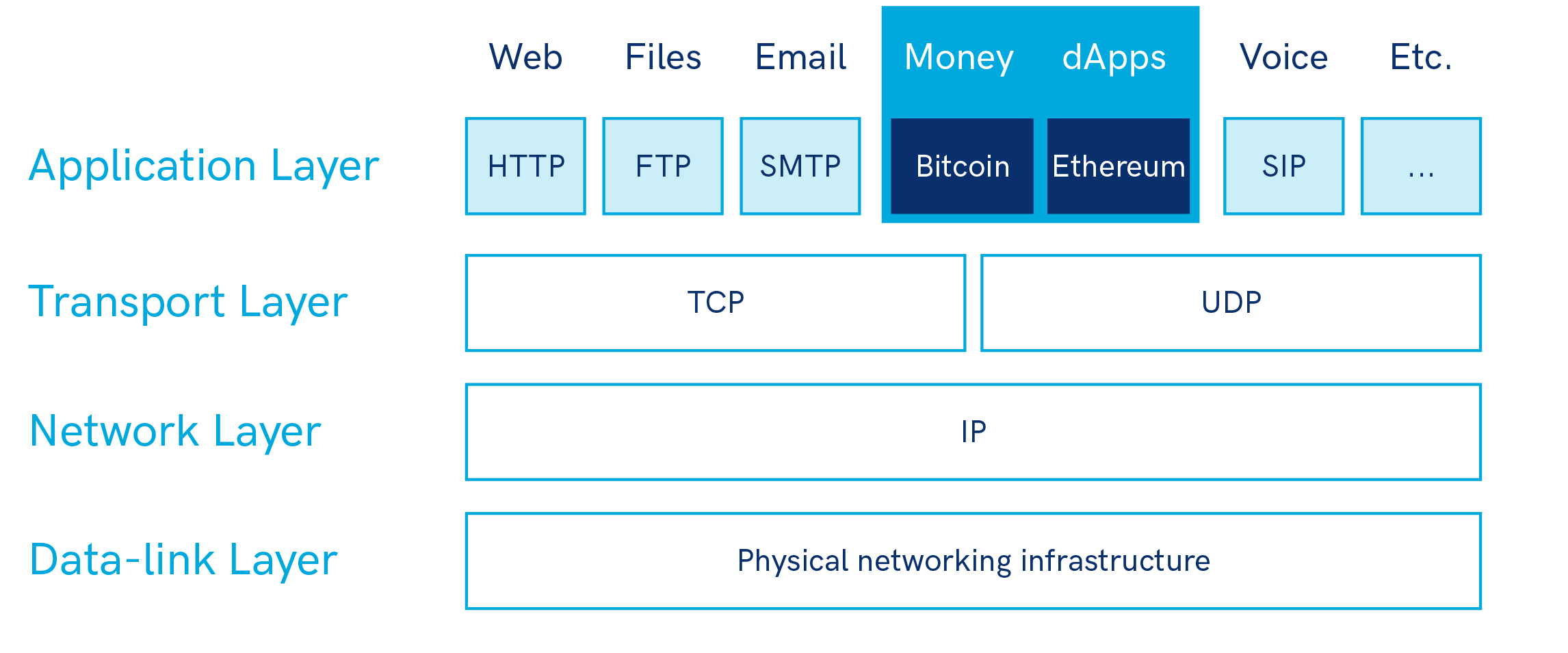

Looking at the bigger picture, cryptoassets and DLT are key to the fourth Industrial Revolution and its use cases are intertwined with technologies such as the Internet of Things, Big Data and Artificial Intelligence. Crypto is a next-generation, value-based internet. As HTTP and HTML are the platform of the World Wide Web, Ethereum and other crypto networks are the platforms of Web 3.0. Web 3.0 is the integration of Industrial Revolution 4.0 technologies and native value management into the internet, for example, internal native payments. So far, in finance, the financial payment rails have been kept separate from the Web, but in a digital world where data, money and value are so intertwined, this separation makes less and less sense. In the same way that the Web today enables many services, software built on Web 3.0 is already providing a wide range of valuable services to consumers, such as decentralised lending and borrowing and decentralised exchanges.

Figure 4: Web 3.0 via DLT / Blockchain

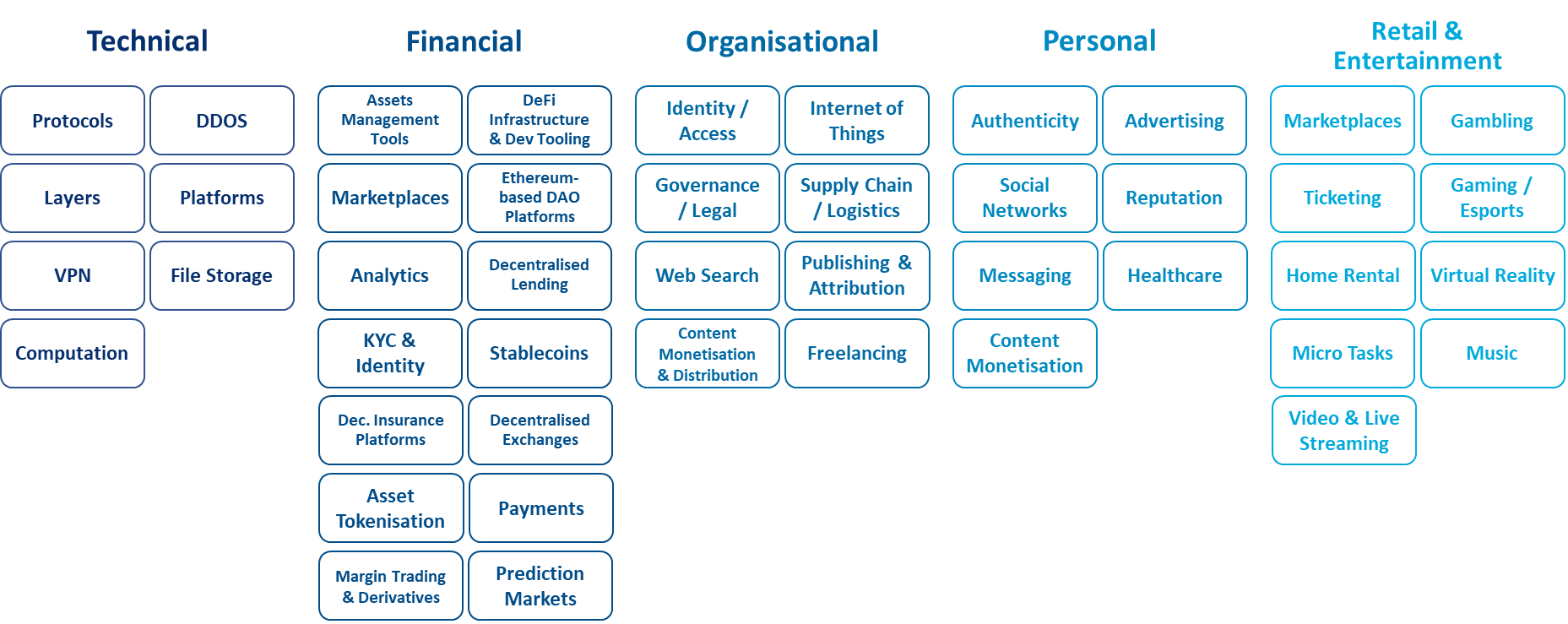

This technology has the potential to disrupt virtually every industry and has applications throughout many different value chains. Key areas for disruption are finance, insurance, healthcare, supply chains and digital identity. McKinsey has identified over 90 use cases across 14 industries. Governments, banks, and other large corporations are now getting behind both cryptoasset and DLT. Many established companies, ranging from Amazon to JP Morgan to Paypal, are now involved. Estimates by groups like PwC and Gartner Research on the value that Blockchain technology will deliver by 2030 range into Trillions of Dollars. The numbers and implications of this technology are tremendous 7,8.

Figure 5: Web 3.0 Use Case

Footnotes

1 For latest figures see https://www.cryptocompare.com/

2 For more details on the history of Ethereum, see https://coinloan.io/article/the-complete-history-of-ethereum-eth/.

3 For more details on the Merge, see https://ethereum.org/en/upgrades/merge/#what-is-the-merge.

4 For more details, see https://chaindebrief.com/what-are-replay-attacks-what-you-need-to-know-before-ethereums-merge/.

5 For a more in-depth discussion of the merits of decentralisation, see https://haseebq.com/why-decentralization-isnt-as-important-as-you-think/.

6 For more details on the market dominance of Lido, see https://cointelegraph.com/news/lido-s-market-dominance-and-ethereum-decentralization-post-merge.

7 For more information, see: https://www.gartner.com/en/newsroom/press-releases/2019-07-03-gartner-predicts-90--of-current-enterprise-blockchain.

8 For more information, see: http://: https://www.pwc.com/gx/en/industries/technology/publications/blockchain-report-transform-business-economy.html.

Disclaimer