Can Bitcoin or other cryptocurrencies serve as a store of value? We discuss the economic rationale behind this basic function of money and under which conditions it can be fulfilled. While it does show that something intrinsically worthless can rationally be used to store value, we argue that a fixed supply is not sufficient for stable prices. We also show that adoption of current forms of money can decline abruptly if younger generations are expected to favor alternatives.

Introduction

Money has three main functions. It is a medium of exchange, if it is used to buy and sell goods and services. It is a unit of account, if all prices of goods and services are quoted in terms of its units. Finally, it is a store of value, if people believe that it will retain its purchasing power over time. In this note, we explore the economic rationale behind the store of value of property of money.

The main economic rationale for money serving as a store of value can be explained using the overlapping generations model. Such intertemporal models are a basic building block of modern macroeconomic models, used by economists and central banks alike. This model’s distinctive feature is that different generations of people use money to ”transfer” value from one period to another. For this to happen in an effective way, they need to expect that prices will remain stable over time, otherwise money cannot act as a store of value. A money’s ability to be useful as a store of value is not dependent on any intrinsic value of the money used. The key determinant of a money’s value are societies’ expectations about the future value of money i.e. future price inflation or deflation.

One interesting aspect of this model is that it clears the popular misconception that if the money supply is fixed, then its value will increase over time or at least stay the same. We show that this is not necessarily true and that we can have hyperinflation even with a fixed money supply. This is important to consider for Bitcoin, or other cryptocurrencies that will eventually have a constant supply, as this property is not enough to guarantee that prices will necessarily become stable. As we see in the model, expectations about future prices are a main determinant of price stability.

On the other hand, this simple model provides a cautionary tale for existing forms of money. Money acts as a store of value as long as each new generation of people is willing to accept an intrinsically worthless object in exchange for goods and services, because they think that the generation after them will also do the same. If one of these new generations starts shifting toward new forms of money in the not-so-distant future, it may become inevitable that the current form of money is abandoned.

Overlapping Generations Model of Money

We now describe a simplified version of the overlapping generations model. For simplicity, there is only one good in the economy that is worth consuming. This good is perishable, so that if it is not consumed today, it vanishes by tomorrow. We make this assumption to emphasise the role of money in transferring value across periods. The money used in the economy is intrinsically worthless but durable, i.e. fiat money.

In every period, a new generation of people is born. Each person lives for two periods. Initially they are young and they coexist with the older generation, which was born in the previous period. In the next period, they become old and they coexist with the new generation of young people.

Each person produces some units of the consumption good during the periods in which they are alive. A young person can produce more units than an old person. However, each member of the old generation has an amount of money, m, which they can use to buy some units of the good from the young generation. In that way, money is transferred to the young generation. When they become old, they will then use this money to buy the newly produced units of the consumption good, from the young generation.

Intergenerational Trust and Backward Induction

In this simple model, money acts as a store of value, because it allows people to smooth their consumption: they consume less than what they produce when they are young, in exchange for consuming more than what they produce in the next period, when they become old. However, this transfer of value is possible only if there is always a next young generation, willing to receive the intrinsically worthless money, in exchange for goods.

To see why this is important, suppose that the society only lives for a set number of periods. For example, suppose that in period 100 there is only an old generation and no one new is born. In period 99, they are the young generation. As they know that in period 100 they will not be able to give the money that they have to a young generation, they are unwilling to accept any money now in period 99, in exchange for goods. This makes the old generation in period 99 reluctant to receive any money in period 98, when they are young. Continuing by backward induction, the young generation in period 1 is not willing to take any money. In other words, the value of money is 0 from the beginning and it cannot act as store of value. There is no trade across periods and each generation consumes what they produce.

Even if society is unlikely to die out in the foreseeable future, however, this example serves as a cautionary tale. It could be that a future young generation stops accepting the ”old” form of money, as their tastes have changed and they prefer to use different forms of money, which albeit may be equally intrinsically worthless. If it becomes common knowledge today that this intergenerational trust will break in the not-so-distant future, backward induction implies that the value of the current form of money may collapse today.

Price Equilibria

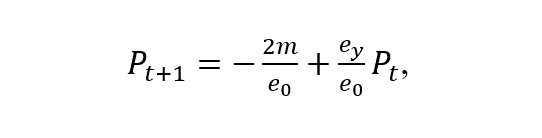

Even if there is always intergenerational trust, so that the new generation will always accept the same form of money from the old generation, prices may not be stable, resulting in inflation or deflation. By solving this simple model, we can derive the following function between the price level at period t, denoted Pt, and the price level at period t+1, denoted Pt+1, where ey and eo are the units of the consumption good produced by each member of the young and the old generation, respectively.1

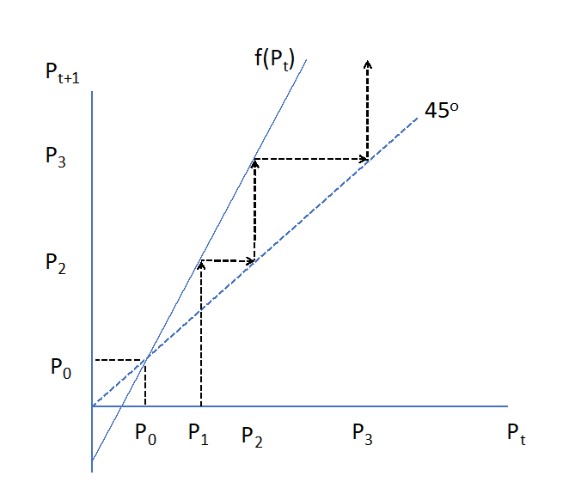

Figure 1 maps this equation, denoted f(Pt). Because we have assumed that young people are able to produce more than old people, i.e. ey is bigger than eo, the slope of f(Pt) is larger than that of the 45o degree dashed line, with a slope of 1.

Figure 1: Stationary and self-fulfilling inflation equilibria

We can now trace the various scenarios of how prices change over time. If we start in period 1 at the price level P1 on the horizonal axis, everyone will realise that in period 2 the prices are going to be higher at P2, which will then lead to even higher prices P3 in period 3, and so on. This price inflation is shown through the dashed arrows. This is a non-stationary equilibrium, as prices increase in every period, leading to hyperinflation, where money eventually becomes worthless. Similarly, if we started at a price level which is below P0, prices would continue to decline, so that money would appreciate in value. Stable prices only exist when the initial price is P0, as all subsequent prices are also P0 i.e. there is no inflation or deflation.

In this model, prices and hence the value of money are nothing more than a self-fulfilling prophecy. The hyperinflation scenario depicted by the dashed arrows is a self-fulfilling prophecy, in the sense that people have rational expectations, and they correctly anticipate how prices will increase in the future. If, on the other hand, we assume that people are not very sophisticated, such that their expectations are adaptive, then the stationary equilibrium P0 can be achieved more easily. Several experimental papers study how prices evolve and try to understand under which conditions stable or non-stable prices are more likely.2

Conclusion

While this very simple overlapping generations model abstracts from the complexity of the real world, its simplicity allows us to isolate and understand several critical insights at the core of how money functions as a store of value. This model shows how the value of fiat money is a self-fulfilling prophecy which is determined by future expectations around inflation and deflation and that money in fixed supply is not a guarantee for stable prices. Under some conditions, it could lead to hyperinflation. It also shows that the store of value property depends on each new generation accepting that this specific form of money will also be accepted by the generations that are not yet born. If this is not true, backward induction implies that current forms of money can be abandoned fairly quickly.

Such intertemporal models are a basic building block of modern macroeconomic models used by economists and central banks alike. The model can be extended in various dimensions to closer reflect the complexity of the real world. First, we could assume a steady growth of the money supply. If the growth is relatively small, two stationary price equilibria are generated with rational expectations, one with low and one with high inflation.3 We initially assumed only one consumption good, in order to avoid the double coincidence of wants problem, which motivates the medium of exchange property of money. A more realistic model would allow for multiple consumption goods. Finally, we have assumed that there is only one form of money. Realistically, there are many different forms of money and tokens, so that there is competition between them, which generates very interesting dynamics.

Footnotes

1 For more details about the model, Duffy, John. "Monetary theory in the laboratory." Federal Reserve Bank of St. Louis Review 80, no. 5 (1998): 9, https://www.socsci.uci.edu/~duffy/papers/stlreview.pdf.

2 For a review of the literature, see Duffy, John. "Monetary theory in the laboratory." Federal Reserve Bank of St. Louis Review 80, no. 5 (1998): 9, https://www.socsci.uci.edu/~duffy/papers/stlreview.pdf.

3 For more details, see Marimon, Ramon, and Shyam Sunder. “Indeterminacy of Equilibria in a Hyperinflationary World: Experimental Evidence,” Econometrica (September 1993), pp. 1073-107.